Add Petronet LNG Ltd For Target Rs.305 By JM Financial Services Ltd

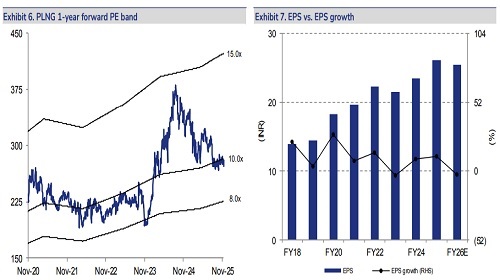

We visited Petronet LNG’s (PLNG) flagship Dahej LNG regas terminal and interacted with the management to understand the company’s key growth prospects and potential challenges. The management reiterated the advantages and synergies of the company’s petchem project in terms of capex and opex saving. It also highlighted that the INR 20bn 3rd jetty in Dahej is also being designed with the capacity of 10mmtpa (similar to its existing 1st and 2nd jetty with 10mmtpa capacity each); however, 3rd jetty would also be able to unload propane (~1mmtpa) and ethane (~1mmtpa) along with LNG (balance capacity); hence, PLNG is looking to tap opportunities in sourcing and marketing of ethane and propane as well. The management is not concerned about under-utilisation of Dahej 5mmtpa capacity expansion due to robust outlook for India’s gas demand; it expects positive renegotiation of Dahej regas tariff soon as Dahej offers the lowest regas charges with the best evacuation facilities. It also expects the INR 65bn 5mmtpa Gopalpur terminal to perform like the Dahej terminal given good pipeline connectivity and also because it sees eastern India emerging as a gas demand centre. We maintain ADD (unchanged TP of INR 305) on valuation grounds but capital misallocation risks continue due to the management’s aggressive capex plans in the non-core petchem business, which could be value-destructive as they are outside PLNG’s core competence amidst muted outlook for petchem margins given surplus global capacity. At CMP, PLNG trades at 9x FY28E P/E (3-year avg: 10.6x) and 1.5x FY28E P/B (3-year avg: 2.1x).

* Reiterates petchem project advantages and synergies; PLNG looking to tap opportunity in sourcing and marketing of ethane and propane: Referring to the company’s INR 207bn 750 KTPA of PDH & 500 KTPA of PP project, the PLNG management reiterated the advantages and synergies in the project

a) reduction in capex as the INR 20bn 2.5km 3 rd jetty in Dahej with the capacity of 10mmtpa (similar to the its 1st and 2nd Jetty with 10mmtpa capacity each) would also be able to unload propane (~1mmtpa) and ethane (~1mmtpa) along with LNG (balance capacity);

b) capex saving of INR 3.5-4bn due to cold energy integration; c) opex saving of INR 1.2bn p.a. due to ~19MW of power saving as cold energy of regas plant will be used for the petchem project. On ethane sourcing, it reiterated that PLNG was working on both models and was in advanced stages of discussions with offtakers: a) offtakers can bring their own ethane volume and PLNG will just handle volume, like in the regas service contract; and b) it is also in discussions with offtakers for sourcing of ethane if the offtaker agrees to commit capacity usage. It is to be noted that Qatargas supplies rich gas as part of its 7.5mmtpa contract till Apr’28 (and ethane from the same is supplied to OPAL). However, post Apr’28, Qatargas will only supply lean LNG; hence, OPAL will need to import ethane and even other players (IOCL, BPCL’s Bina refinery, HMEL’s Bathinda refinery etc) can import ethane using PLNG’s Dahej ethane import facility. ONGC’s OPAL ethane volume would be mostly on tolling basis (volume to be sourced by ONGC). Separately, PLNG is also looking at becoming an aggregator for propane sourcing. Further, the management said that the petchem project was on track; tenders have been floated for most of the required LLIs (long-lead items) and packages and the project is likely to be commissioned in 4QFY28. The management is hopeful petchem margin will improve by the time the project is commissioned; it also reiterated that it expects to earn atleast its threshold 16% equity IRR from the petchem project and also from other projects that are approved by the board.

* Maintain ADD on valuation grounds; but capital misallocation risks continue to exist: We maintain ADD on PLNG (unchanged TP of INR 305) on valuation grounds but capital misallocation risks continue due to the management’s aggressive capex plans in the non-core petchem business, which could be value-destructive as they are outside PLNG’s core competence amidst muted outlook for petchem margins given surplus global capacity. At CMP, PLNG trades at 9x FY28E P/E (3-year avg: 10.6x) and 1.5x FY28E P/B (3-year avg: 2.1x).

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361