Buy Indigo Paints Ltd for the Target Rs.1,400 by Motilal Oswal Financial Services Ltd

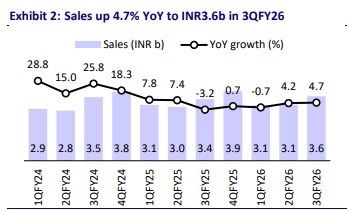

Muted revenue delivery; beat on margins

* Indigo Paints (INDIGOPN) reported standalone sales growth of 3% YoY in 3QFY26 on a soft base (-4%). The sluggish revenue growth was attributed to muted demand in Oct’25, the impact of early Diwali, and the delayed monsoon. However, demand has seen consistent improvement from Nov’25 onwards, with INDIGOPN recording double-digit value growth. The trend has sustained over the last three months (Nov’25–Jan’26), for the first time in the last two years, indicating early signs of demand recovery. While this strengthens the industry’s recovery case for 2026, sustained momentum will need to be closely monitored over the coming months. Price increases are unlikely; however, the company still expects doubledigit revenue growth in 4QFY26 and FY27. Apple Chemie (subsidiary) sales grew 32% YoY. Consolidated sales rose 5% YoY (base -3%) to INR3.6b (miss).

* Gross margin expanded 20bp YoY to 46.8% (in line), led by lower RM prices. INDIGOPN highlighted that raw material prices reached pre-COVID levels in 3QFY26, which helped the company in increasing discounts. A&P expenses as a % of revenue reduced to 5.6% in 3QFY26, compared to 8.2% in the base, resulting in EBITDA margin expansion of 230bp YoY to 19% (beat).

* The paint industry has been witnessing a weak demand trajectory over the last two years, further impacted by competitive pressure. We remain optimistic about a demand recovery in 2026; however, we need to monitor whether any pent-up demand catalysts emerge to drive higher-thanexpected growth. The company is expecting healthy double-digit revenue growth in FY27. It continues to focus on the premium and emulsion segments, with a deliberate shift away from the economy segment. We model a CAGR of 14%/18% in revenue/EBITDA in FY26-28E. We model an EBITDA margin of ~19.5% for FY27/FY28. We reiterate our BUY rating with a TP of INR1,400 (based on 35x Dec’27E EPS), considering its growth outperformance, synergies with Apple Chemie, consistent capacity and distribution expansion, and its favorable valuation multiples vs. peers.

Miss on revenue; low A&P supports profitability Consolidated performance

* Revenue grows in mid-single digits: Consolidated net sales grew 5% YoY to INR3,588m (est. INR3,745m). Standalone revenue grew 3% YoY to INR3,389m. Apple Chemie revenue grew 32% YoY to INR199m.

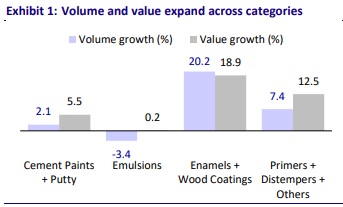

* Premium performing better than the economy segment: In 3QFY26, enamels & wood coatings led performance, delivering 18.9% value growth and 20.2% volume growth. Primers, distempers, and others followed with 12.5% value and 7.4% volume growth. Putty & cement paint posted 5.5% value and 2.1% volume growth. Emulsions remained soft, with 0.2% value growth and a 3.4% volume decline; however, continued traction in premium emulsions supported value growth ahead of volumes, reflecting a resilient premium mix, even as the industry flagged downtrading trends.

* Beat on margins: Gross margin expanded 20bp YoY to 46.8% (est. 47%), led by lower RM prices. Employee expenses rose 14% YoY, while other expenses declined 9% YoY. The company further highlighted that A&P expenses as a % of revenue reduced to 5.6% in 3QFY26 compared to 8.2% in the base. EBITDA margin expanded 230bp YoY to 19% (est. 17.6%).

* Double-digit growth in profitability: EBITDA increased 20% YoY to INR683m (est. INR659m). PBT increased 25% YoY to INR565m (est. INR530m). APAT rose 20% YoY to INR431m (est. INR395m).

* In 9MFY26, revenue/EBITDA/APAT grew 3%/9%/11%, respectively, YoY.

Highlights from the management commentary

* Management indicated that the last three months have witnessed a demand uptick, following a period of weak growth over the last two years.

* The company expects the paint industry to revive from 4QFY26 onwards, recording double-digit growth in 4QFY26. FY27 sales growth can revert to 20% levels if the broader paint category demand revives.

* Birla Opus products were selling at the highest discounts and lowest prices in the market compared to industry peers. Despite recent price increases, the brand remains the cheapest among others.

* Management does not expect any significant changes in pricing in the foreseeable future.

Valuation and view

* We broadly maintain our EPS estimates for FY26-FY28.

* INDIGOPN's strategic shift to focusing on non-metro towns and increased investments in distribution and influencers as part of its Strategy 2.0 is proving to be a successful endeavor. That said, the company continues to focus on the premium and emulsion segments, with a deliberate shift away from the economy segment.

* Given the relatively small scale of INDIGOPN (INR13b revenue in FY25) in the paint industry, the company has been able to grow much faster than the industry. Consumers’ rising acceptance of the brand and the expansion of its distribution network have been driving its outperformance. However, the changing competitive landscape will be a key monitorable. We reiterate our BUY rating with a revised TP of INR1,400 (premised on 35x Dec’27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

Tag News

G R Infraprojects gains on securing LoA worth Rs 1897.51 crore