Buy Tata Consultancy Services Ltd For Target Rs. 3,800 By Prabhudas Lilladher Capital Ltd

Modest Recovery & Margin Expansion, AI Pivot Underway

The quarterly performance exceeded our estimates, revenues and margins were up +0.8% CC QoQ and 70bps QoQ, respectively. The growth was broadbased across verticals and regions; international business was up 0.6% QoQ CC (vs declined ~0.5% QoQ LQ). However, the on-ground demand remains unchanged, the smaller deals and discretionary spends continue to see a pullback. Despite this slowdown, the company accelerated its AI investments strategies with senior leader hirings and powering AI into multiple offerings and service lines. With this AI theme, the company is further doubling-down on building Infrastructure with 1GW capacity AI Datacenter in India. We believe the investment is capturing the relevant theme around building AI Infrastructure and deepening its client relations with Hyperscalers and Tech Partners. The overall Capex seems to be heavy (USD 5-7bn); however, the concrete structure and vendor participation is yet to be decided. On the margins, we might see similar headcount trimming exercise carried out in H2, hence we are revising FY26E/FY27E/FY28E margins up by 40bps/30bps/30bps, while keeping the revenue growth unchanged. We assign 23x to Sep’27 EPS that translates a TP of 3,800. Maintain BUY.

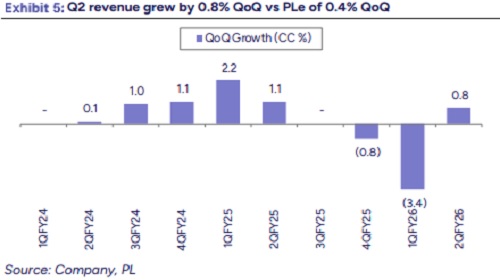

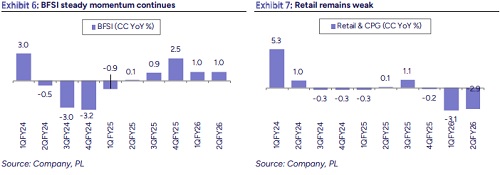

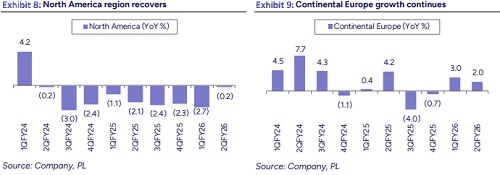

Revenue:

TCS posted a steady recovery in Q2 following a weak Q1, delivering 0.8% QoQ CC revenue growth, ahead of both our and consensus expectations of 0.4% QoQ CC. The international business grew 0.6% QoQ CC, also exceeding expectations. Growth was broad-based across most segments and geographies, with the UK region and the Retail & Regional Markets segment being the only exceptions, as both declined sequentially in CC terms.

Operating Margin:

TCS also delivered an improvement in operating margin, with EBIT margin expanding 70 bps QoQ to 25.2%. The margin walk for the quarter included tailwinds of 80 bps from currency benefits, 40 bps from pyramid restructuring, and 20 bps from operational efficiencies, which were partially offset by a 70-bps headwind from wage hikes. Management reiterated its aspiration to scale margins back to the 26–28% range.

Deal Wins:

Deal wins of USD 10 bn included a mega deal USD 0.6 bn. Excluding the mega deal, overall deal wins were slightly above the company’s USD 7–9 bn comfort range. BFSI, Retail & North America TCV came in at US$2.5 bn (-38% QoQ), US$ 1.6 bn (-6% QoQ) & US$ 4.4 bn (-35% QoQ) respectively with LTM BTB of 1.4x

Valuations and outlook:

We estimate USD revenue/earnings CAGR of 3.6%/9.4% over FY25-FY28E. The stock is currently trading at 18.6x LTM Sep. FY27E earnings, we are assigning P/E of 23x to LTM Sep. FY27E earnings with a target price of INR 3,800. We maintain “BUY” rating.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271