Add Tech Mahindra Ltd For Target Rs. 1,600 By Emkay Global Financial Services Ltd

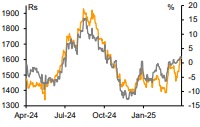

TechM’s results were a mixed bag in Q4, with miss on revenue and improvement in margin. Revenue declined 1.5% CC QoQ to USD1.55bn due to delay in deal renewal in a hi-tech client (BPS segment client) and retail business seasonality. EBITM expanded by 30bps QoQ to 10.5% on the back of operating efficiencies from Project Fortius offsetting the wage hike impact. Deal intake stood strong for a second consecutive quarter at USD798mn, which includes 2 deals of +USD100mn TCV. Consolidation and cost takeout opportunities continue to drive the deal pipeline. TechM continues to prioritize margin over growth in the near term, and is therefore selectively participating in large deals. The company provided update on its Vision FY27 and commented that it is on track to deliver on stated objectives: 1) revenue growth above peer average, 2) EBITM of 15%, 3) ROCE of over 30%, and 4) returns more than 85% of FCF to shareholders. Prolonged period of an uncertain and tough macro environment poses a risk to these goals. We marginally tweak FY26-27E EPS, factoring in the Q4 performance. We retain ADD with unchanged TP of Rs1,600 at 20x Mar-27E EPS.

Results Summary

Revenue declined 1.2% QoQ (down 1.5% CC) to USD1.55bn, below our CC expectation of a 0.3% decline. Revenue for the IT Services and BPS segments declined 0.3% and 5.7% QoQ, respectively. Hi-Tech (8.5% QoQ in USD), HLS (6.2%), RTL (0.3%), and Manufacturing (0.1%) led the decline, whereas BFSI (2.2%) and Communications (1.0%) saw growth in Q4. EBITM expanded by 30bps QoQ as wage hike impact of 100bps was more than offset by operating efficiencies through Project Fortius, Comviva seasonality, and gain from currency movement. Net-new deal wins improved sequentially to USD798mn. Total headcount declined 1.2% QoQ to 148,731, largely owing to fall in BPO headcount. Attrition (LTM) inched up, to 11.8% (vs 11.2% in Q3). What we liked: Healthy deal intake, continued momentum in BFSI. What we did not like: BPS slowdown, softness in the Manufacturing and Technology verticals.

Earnings Call KTAs

1) The tariff uncertainty impacted growth in Q4 (particularly Manufacturing and Hi-tech) owing to cut in discretionary spending in Auto and headwinds in BPS (Hi-tech). 2) Communication vertical is not impacted by tariff so far. However, higher interest rates, possibility of slowdown in consumer spending in US, and lower capex continue to impact tech spending. 3) The management remains confident of making transformation progress, even amid macroeconomic challenges. 4) A conscious decision to scale down its non-core and loss-making portfolio led to ~1% impact on revenue in FY25 with 20- 30bps margin benefit. 5) The mgmt listed some of its margin levers under Project Fortius – FPP optimization with automation and productivity improvement, better price realization, pyramid optimization, and utilization. 6) It added 45 must-have accounts in FY25, each of which provides significant headroom for growth. 7) The company expects the US hi-tech client's renewal decision to be finalized soon. 8) One-time income tax refund led to lower ETR in Q4. ETR is expected to normalize to 26-27% in FY26.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354