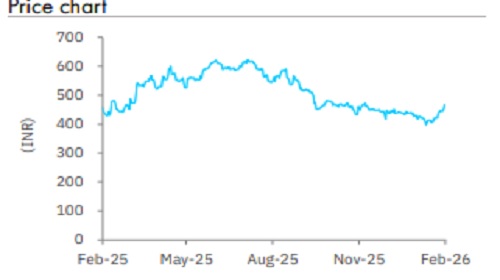

Buy Balrampur Chini Mills Ltd For Target Rs667 By Elara Capital

PLA business to be the key value driver

Balrampur Chini’s (BRCM IN) Q3FY26 results were better than our estimates , led by better sugar business profitability , aided primarily by higher sugar realization . Ethanol volume clocked in 72% growth but stagnant realization amid rising feedstock inflation resulted in lower -than -expected EBITDA for the segment. The Uttar Pradesh (UP) government has increased sugarcane state advised price (SAP) by INR 30 per quintal , which will create margin pressure in FY27 , but 1) sugar price rise, 2) better power reali zation , 3) operating leverage benefits , driven by higher cane crushing , and 4) better yield will offset some input cost pressures. Polylactic Lactic Acid (PLA ) proj ects remains on track to be commission ed by October 2027 and is likely to be a game -changer for BRCM. Business development efforts are on to create large market for PLA consumption. We raise our EBITDA by 14% & PAT by 24% for FY26E and by 3% & 13% for FY27E , respectively , as the negative impact of cane price rise may be lower than our earlier estimates. We re tain Buy with a higher TP of INR 667 based on a SOTP method . We r oll forward valuation to FY28.

Healthy crushing; recovery improves despite lower cane acreage: Sugarcane crushing during the quarter increased 8.4% YoY to ~ 3.9mn tonne, driven by the early commencement of operations and improved capacity utili zation. Gross sugar recovery improved slight ly to ~ 10.6%. Despite a decline in overall sugarcane acreage in UP, management expects company - level crushing to remain higher, led by incremental cane area allocation from the State Government.

PLA market development gaining momentum: PLA business development efforts are progressing well, with 175+ customers targeted and active engagement with 50+ customers across direct & hybrid models. Of 30+ customer trials underway, > 20 have been successfully completed, indicating improving product acceptance. The company target s institutional opportunities, including Railways, defence , and temple projects. Technology development continues across conversion applications , such as BOPLA, bottles, cutlery, films, and carry bags, supported by an expandi ng sales presence in four locations. Parallel ly , there has been progress on biodegradable Gutkha packaging standards, with product development initiatives supported at the policy level.

Retain Buy with a higher TP of INR 667: PLA projects remains on track to be commission ed by October 2027 and is likely to be a game -changer for BRCM. Business development efforts are on going to create large market for PLA consumption. We increase our EBITDA and PAT by 14% & 24% for FY26E and 3% & 13% for FY27E , respectively, as 1) sugar price rise, 2) better power reali zation , 3) operating leverage benefits driven by higher cane crushing , and 4) better yield will offset some input cost pressures. We re tain Buy with a higher TP of INR 667 from INR 584 based on a SOTP method, assuming on 11x (unchanged) FY28E EV/EBITDA for the sugar & distillery businesses and 15x (unchanged) FY28E EV/EBITDA to the PLA business. We r oll forward valuation to FY28.

Please refer disclaimer at Report

SEBI Registration number is INH000000933