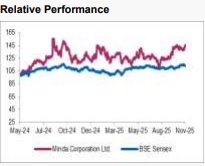

Buy Minda Corporation Ltd For the Target Rs.690 by Axis Securities Ltd

Strong Performance Backed by Tech-Led Premiumization

Est. Vs. Actual for Q2FY26: Revenue – BEAT; EBITDA Margin – BEAT; PAT – BEAT

Change in Estimates Post Q2FY26

FY26E/FY27E: Revenue: 1.8%/2.2%; EBITDA: 3.5%/4.6%; PAT: 6.6%/6.7%

Recommendation Rationale

* Vision 2030 – Strategic Roadmap for Sustainable Value Creation: MCL’s long-term Vision 2030 outlines an ambitious yet well-defined growth roadmap anchored around five strategic pillars: (1) Investment in Core Businesses: Strengthening established verticals such as wiring harness and die casting to maintain leadership. (2) New Market and Export Expansion: Building presence in new geographies with a focus on cost and technology leadership. (3) Premiumization of Product Portfolio: Increasing content per vehicle through high-value, technology-intensive components. (4) New Product Development: Diversifying into emerging product categories such as sunroofs, high-voltage EV harnesses, and digital instrument clusters. (5) Focused R&D Investments: Enhancing design, simulation, and localisation capabilities to deliver cutting-edge solutions for ICE and EV platforms. Through these pillars, MCL targets a 20–25% revenue CAGR over the medium term and aims to expand consolidated EBITDA margins beyond 12.5% across all business verticals (2W, 3W, PV). The company’s execution strategy emphasises capital efficiency, disciplined allocation, and technology-driven differentiation.

* Strong Order Book: Minda Corporation’s order book provides strong revenue visibility and underscores its accelerating transition toward premium and technology-driven products. The company reported a record lifetime order book exceeding Rs 3,600 Cr in H1FY26, anchored by marquee wins across sunroofs, high-voltage wiring harness, TFT digital clusters, and smart key systems.

* Product Portfolio Expansion and Key Order Wins: MCL’s order wins during H1FY26 underscore its transition toward higher-value, premium categories and deeper penetration in the passenger vehicle (PV) segment. MCL secured its first-ever sunroof order from a leading OEM through a 50:50 joint venture with CMF. Commercial production is expected in Q1FY27, with peak contribution anticipated in FY28. This marks MCL’s strategic entry into the premium PV accessories domain. Furthermore, the company received its first high-voltage harness order from one of India’s largest global EV OEMs in the PV category. Localisation will be achieved through its Senko partnership, marking a milestone in EV component integration. Along with this, multiple platform-level orders were secured for TFT clusters ranging from 3-inch to 12.3- inch screens across PV, CV, 2W, and 3W applications. These wins reinforce MCL’s strength in the electronic content space. Through its collaboration with Toyota Denso, MCL bagged new switch orders from leading OEMs, with SOP targeted for Q4FY27. Smart Key Systems (2W) currently have a penetration level of 3–5%, with a long-term target of 25–30% by 2030, supported by the growing adoption of connected mobility solutions. These new products collectively enhance MCL’s content per vehicle and pave the way for deeper integration with global OEMs.

Sector Outlook: Positive

Company Outlook & Guidance: Management expects 15–17% growth in FY26, with low doubledigit CAGR visibility over the medium term. EBITDA margins are projected to stay above 11%, driven by operating leverage, product mix enhancement, and contributions from new EV programs.

Current Valuation: 33x on FY28E EPS (earlier 36x FY28E EPS)

Current TP: Rs 690/share (Unchanged)

Recommendation: We recommend a BUY on the stock.

Financial Performance: In Q2FY26, revenue (beat) grew 19%/11% YoY/QoQ. EBITDA stood at Rs 178 Cr (7% beat), up 21%/14% YoY/QoQ. EBITDA margins (beat) expanded by 22 bps YoY and 31 bps QoQ, driven by product premiumisation, improved efficiencies, and cost control measures. PAT was Rs 85 Cr (16% beat), up 14%/30% YoY/QoQ, as higher financing and depreciation costs were partly offset by the share of profits from associates.

Outlook: We remain positive on Minda Corp’s growth trajectory, underpinned by new order wins and a clear focus on EVs. Backed by a robust order book and management’s confidence in outperforming industry growth through both organic and inorganic routes, we project a CAGR of 15%/19%/25% in Revenue/EBITDA/Adj PAT over FY25-28E, with a higher share of profits from associates expected to further support PAT growth.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

Ltd.jpg)