Q3FY26 Quarterly Result Review : Structural Tailwinds to Support Steady Growth by Choice Institutional Equities

Q3FY26: Strong Momentum Supported by Festive Demand, Rural Recovery and Policy Support

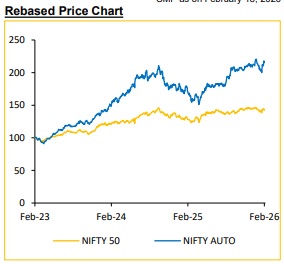

The auto sector delivered a solid performance in Q3FY26, supported by a strong festive and wedding-season demand led by GST rationalisation, improving rural cash flows and a favourable policy environment. Dealer confidence remained high, with better showroom enquiries and improved conversion rates across segments. A growth focussed Union Budget, continued infrastructure spending and stable interest rates helped improve customer affordability and buying confidence.

Importantly, progress on the India–EU FTA and the US trade deal is a strong positive for both, auto OEMs and auto ancillaries, as it can lower tariffs, expand export opportunities, improve scale efficiencies and enhance global competitiveness across the automotive value chain.

Additionally, the proposed draft of tighter CAFE fuel-efficiency norms is expected to have a higher impact on the passenger vehicle segment particularly small and mass-market cars, while accelerating the shift toward hybrids, EVs and fuel-efficient technologies, with manageable compliance impact if thresholds are rationalised

Looking ahead, we remain optimistic on the automobile sector, supported by wedding and festive (Shivratri, Navratri, Gudi Padwa and Ugadi) demand, steady rural income and stable financing conditions.

Above views are of the author and not of the website kindly read disclaimer

More News

Banking Sector Update : A modest relaxation for Small Finance Banks by Kotak Institutional ...