Monthly Auto Sales - February 2025 by ARETE Securities Ltd

In Feb 2025, India's auto sector showed mixed results. Domestic sales softened across most segments due to a post-festive slowdown and the shorter month, while exports surged to offset weaker home demand. PV saw a monthly dip in domestic sales, yet MSIL and M&M posted annual gains driven by strong SUV demand, and HMIL and TAMO relied on exports to counter local declines. CVs had a modest monthly uptick, fueled by trucks and LCVs, with buses hinting at a revival tied to government schemes. 2Ws faced a domestic sales drop after last month's pre-buying, but exports soared, with TVS shining while HERO and BAJAJ trailed. Tractors had uneven domestic results, though M&M and ESC saw strong export growth. Looking ahead, new model launches, rural demand shifts, and initiatives like the PM eBus Sewa scheme should lift sales in March and beyond.

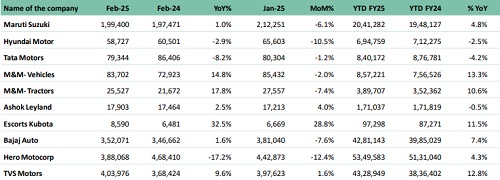

Automobile Sales February - 2025

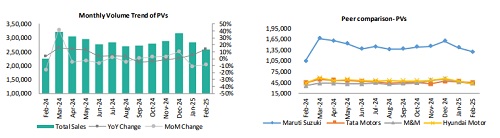

PV Segment

In February, the PV segment experienced sequential decline, with all car OEMs struggling to increase vehicle sales. This was likely due to fewer days in the month and reduced consumer activity following the post-festive season slowdown. On a YoY basis, only MSIL and M&M achieved positive growth. MSIL's success stemmed from strong demand in its compact and SUV segments, while M&M benefited from its diversified SUV portfolio. HMIL, despite introducing diverse powertrain options, saw domestic sales decline, with growth limited to its export markets. Similarly, TAMO appeared to prioritize EV infrastructure development over domestic sales, though its exports posted significant gains. Overall, the PV segment displayed a mixed performance, shaped by seasonal challenges and differing strategic priorities among OEMs, with exports providing a bright spot for some manufacturers.

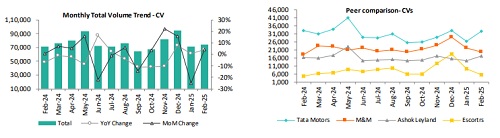

CV Segment

In February, the CV segment increased by 4% MoM and 1% YoY, marking its fourth consecutive monthly rise. Domestic trucks, which account for 24% of CV volumes, rose 9% MoM but declined 9% YoY, reflecting some volatility, though stronger infrastructure activity could support future demand. Bus sales in domestic market dropped 8% MoM; however, the expected deployment of eBuses under the PM eBus Sewa scheme should spur a recovery in coming months. LCV sales rose 5% MoM and 0.2% YoY, driven by rural last-mile delivery demand. For tractors, domestic sales showed mixed results where M&M experienced a sequential decline of 9%, while ESC recorded a 32% MoM increase. Both companies performed strongly in exports achieving robust growth. Overall, February's results depict a sector with mixed dynamics: growth in domestic trucks and LCVs, weakness in buses, and tractors showing domestic variability with export strength.

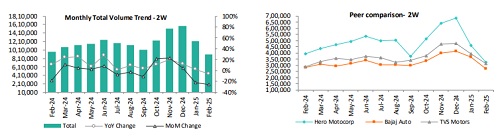

2W Segment

In the 2W segment this month, domestic sales underperformed, with volumes dropping 12% YoY and 11% MoM, driven by a prebuying effect from prior discounts, while exports rose 26% YoY and 7% MoM, tempering the overall sales decline to 7% MoM and 4% YoY. HERO spearheaded the downturn, posting the steepest volume fall. Conversely, TVS emerged as the sole gainer, recording a 1% MoM and 10% YoY uptick. BAJAJ's domestic dispatch slump minimally impacted volumes YoY, buoyed by a 2% YoY export-led gain, though a 9% MoM drop reflected weaker domestic and global dispatches. Overall, the 2W market exhibited mixed performance, with export strength offsetting domestic weakness to varying degrees across key players.

Please refer disclaimer at http://www.aretesecurities.com/

SEBI Regn. No.: INM0000127

More News

Consumer Retail Sector Update : GST rate rationalisation: Shot in the arm at the right time ...