Banking Sector Update : Select banks, SFBs better placed to play the MFI recovery story by Emkay Global Financial Services Ltd

Over the past one year, the Microfinance sector has undergone a much needed reset with the imposition of MFIN guardrails which in turn led to higher NPAs, exposing sector vulnerability and pushing a few players almost toward existential crisis and others into losses. We believe that this reset is likely to push hard for geographic/product diversification, re-calibrate lending/collection strategies, and hopefully contingency buffers. We hereby highlight in detail the outlook on the MFI sector, based on discussions with experts and our perspective on what lies ahead.

MFI stress moderation to begin from H2FY26E

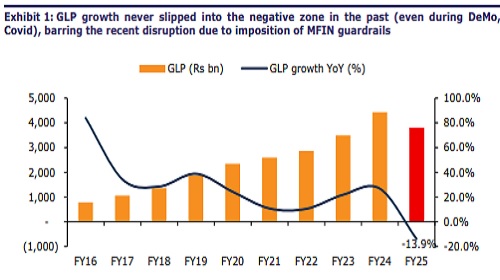

After Andhra crisis, demonetization, and Covid, the imposition of MFIN guardrails (a cap of three lenders per borrower and Rs0.2mn loan exposure limit) and the resultant rise in stress have exposed sector vulnerability once again, even pushing a few players toward existential crisis. This was further accentuated by the ordinances in Karnataka and then TN, hurting collection efficiencies and leading to GLP de-growth for the first time in a decade in FY25. At the peak, the industry’s PAR book in 0-180 DPD shot up to 8.2% in Dec-24. Our channel checks suggest that stress flow in Q1FY26 could likely remain elevated (also reflected in recent business updates) due to seasonal weakness and owing to Karnataka/TN ordinances. We believe unwinding of the residual 3+ lender portfolio at 12% in Mar-25 (down from 19% in Mar-24) will keep near-term stress flow elevated, but it will ease from H2FY26E, leading to steady improvement in asset quality/LLP. We believe banks (eg: Ujjivan, Bandhan) with a relatively lower share of 3+ lenders will be early to benefit from the recovery cycle.

Frequent disruptions, recent regulatory easing to accelerate portfolio diversification away from MFI

Frequent growth and asset quality disruptions in the MFI sector slowly pushed lenders toward alternate growth levers (Gold, Mortgage, AFH, MSE, VF, etc.). The recent reduction in qualifying asset classification threshold for NBFC-MFIs and SFBs to 60%, from 75%, should further accelerate portfolio diversification. However, we believe that the pivot to a diversified portfolio, from a pure-play NBFC-MFI, will require specialized underwriting skills, robust risk management models, product domain expertise and may even necessitate the need for a refreshed management team which is challenging. Geographic and portfolio diversifications attempted by banks like Bandhan and Ujjivan too had their share of pain, but are likely to accelerate the pace of diversification.

Rising share of individual loans should be monitored and regulated

Our channel checks suggest an increasing trend among MFI lenders, including SFBs, to extend individual loans to JLG borrowers, as a strategy to retain customers. In some cases, though, this could be a tactical manner of bypassing regulatory guardrails and suppressing stress. Also, many lenders are chasing these customers and could lead to overleveraging similar to JLG borrowers. Thus, we believe that MFIN should issue some regulatory guidelines for individual loans as well. Additionally, we believe that NBFC-MFIs need to build strong internal collection teams, hire senior chief credit and risk officers, and even build contingent provision buffers (like large banks as they increase their share of unsecured loans) to limit the impact on Profit and Loss account.

Prefer banks to play the MFI recovery story

While stress flows may remain elevated in H1FY26, we expect a meaningful decline in NPA formation and LLP from H2FY26, barring any unforeseen political or climatic disruptions. We prefer banks like Ujjivan (BUY) and Bandhan (ADD) to play the MFI recovery and asset diversification theme. Ujjivan SFB, a potential candidate for the Universal Bank license (similar to AU SFB), is well-positioned to deliver >2% RoA and stronger growth, but still trades at a steep discount (1.2x FY27E ABV) to AU SFB (2.8x), warranting a re-rating. We retain BUY on Ujjivan with revised TP of Rs60 (up 20%), valuing at 1.4x Jun-27E ABV. RBL, with exposure to MFI (6%) and Cards (18%), is a play on strong asset quality recovery; we raise our TP by 20% to Rs300 (1x Jun-27E ABV). We also retain ADD on Credag with revised TP of Rs1,350 (up 10%), valuing at 2.1x Jun27E ABV, given its credible track record to ride the MFI recovery story and deliver strong RoA (3-5% over FY26-28E).

Story in charts

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354