Q3FY26 Quarterly Results Review : Premiumization and Backward Integration to Drive Earnings by Choice Institutional Equities

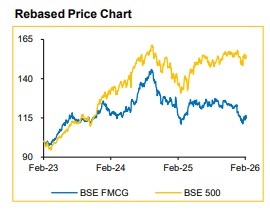

Sector Outlook

Muted Volume in Q3FY26: Alcobev industry witnessed a subdued revenue growth in Q3FY26 due to adverse impact of policy in Maharashtra and Telangana. However, policies in Uttar Pradesh and Andhra Pradesh favoured national Alcobev companies. Despite a muted volume growth in some portfolios, Prestige & Above (P&A) segment continued to grow for most companies, improving margin trajectory. Further, stable input cost and a benign outlook support heightened margin trajectory

Mixed impact from trade deals: While the UK FTA is structurally positive, improving margin by lowering duties on bulk scotch whisky, US and EU FTAs are expected to increase competition for local companies, albeit import volumes are projected to be capped, thus mitigating risk

Q4FY26E Outlook: We expect Q4FY26E volume growth to remain healthy YoY for the sector, supported by premiumization, resolution of one-off issues in certain states and wedding season.

RDCK and ABDL remain our preferred investment ideas for the sector, supported by twin structural tailwinds of increased P&A launches and backward integration.

More News

Metals & Mining Sector Update : Raw material prices continue to ease by By Elara Capital