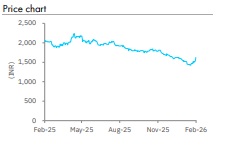

Reduce United Breweries Ltd for Target Rs 1,700 by Elara Capital

In Q3, United Breweries’ (UBBL IN) value growth beat our estimates, primarily driven by a 5.0% YoY improvement in realizations. However, underlying volume dropped 1.3% YoY, largely due to adverse weather and sharp industry-level decline in Telangana, Rajasthan and Karnataka. This was partly offset by better momentum in Maharashtra and Andhra Pradesh. On the profitability front, EBITDAM rose 382bps YoY to 10.9%, aided by 222bps gross margin improvement and ~190bps opex savings. Given Q3 performance, we pare our FY25-28E revenue/EPS estimates by 3-6%. Despite a c9% correction in the stock price in past three months, UBBL trades at 50x FY28E P/E. So, we retain Reduce. We reduce our TP to INR 1,700.

Volume pressure continues: While UBBL’s revenue grew 3.7% YoY, this was primarily led by realization gain of 5.0% YoY to INR 482, as overall volumes reduced by 1.3% YoY to 43.0mn cases. The drop in volume was characterized by: a) continued adverse weather in Q3 in key operating parts, and b) demand pressure in Telangana, Rajasthan and Karnataka (posting double-digit volume decline at industry level). However, momentum in Maharashtra and Andhra Pradesh partially offset the decline. Realization gain was led by price hike in Telangana, Rajasthan, and Uttar Pradesh and positive state mix. With this, UBBL’s 9M volume/price growth was muted at 2.7%/3.2% YoY. So, we expect FY26E volume/price to grow 2.5%/3.5% YoY respectively. Premium volume grew 23% YTD.

EBITDA margin grew at healthy pace: UBBL’s EBITDA margin grew a strong 382bps YoY to 10.9% in Q3, driven by higher gross margin (222bps), and lower other expenses (190bps), though partly offset by employee costs (30bps). Price realization gains aided gross margin. Oher expenses reduced, reflecting ongoing productivity and cost-effectiveness program (UBBL expects this to continue though FY27). Per UBBL, this program could deliver 3-6% gross saving overtime but expect much of the gain to be invested back in driving strategic growth (e.g., installing VC coolers). We see UBBL’s EBITDAM reaching 12.0% by FY28E

Retain Reduce; TP pared to INR 1,700: While in Q3, value growth beat estimates, underlying volume growth was muted. Affordability is the key overhang on the beer category, with adverse weather further increasing growth sensitivity. Expect Industry volume growth to be in mid single-digit (6-7% in the past). Per assessment, premium growth in Q3 was likely 1% YoY, due to pullback in A&P spend. Growth drivers are external – Favorable weather, rationalization of duties, competitive intensity (UBBL has been proactive on internal growth measures).

At CMP, the stock trades at a premium ~50x FY28E P/E despite ~9% price correction in the past three months. Factoring in Q3, we pare our revenue estimates by 3-6% and EPS estimates by 3-5% in FY25-28E, resulting in lower TP of INR 1,700 (from INR 1,800) as we value UBBL on 53x P/E (unchanged) Dec-27E. Maintain Reduce. Key near-term monitorables are sustained margin improvement, returning volume growth and balance between A&P spending and driving premium category growth.

Please refer disclaimer at Report

SEBI Registration number is INH000000933