Sell Relaxo Footwears Ltd For Target Rs. 473 By Yes Securities Ltd

Volumes decline sharply, downgrade earnings; maintain SELL!

Result Synopsis

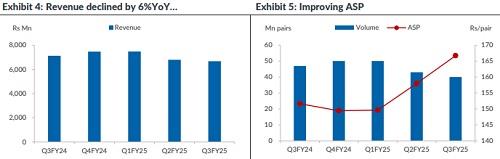

Relaxo Footwears Ltd (RLXF), registered a weak performance for Q3FY25. Company’s revenue declined by 6%YoY & 2%QoQ to Rs6.67Bn. However, the only cheer was the improvement in ASP from Rs152/Rs158 per pair in Q3FY24/Q2FY25 respectively to Rs167 per pair in Q3FY25. This improvement in realization cushioned the blow caused by 15%YoY decline in volume during the quarter (2-years volume CAGR stood at -1%). Volumes were under pressure owing to soft demand coupled with enhanced competitive pressure. For 9MFY25, volumes degrew by 9%YoY and ASP improved by 6% over similar period. Hence, overall revenue declined marginally by 3%YoY.

Gross margins came in at 57% Vs 57%/61% in Q3FY24/Q2FY25 respectively. However, EBITDA margins improved marginally to 12.5% Vs 12.2% in Q3FY24 and largely remained steady on sequential basis. The operating margins were steady owing to reduction in other expenses which as as%sales came in at 30.2% as compared to 31.3%/32.5% in Q3FY24/Q2FY25 respectively. For 9MFY25, gross margins came in at 60% Vs 57% in 9MFY24 and operating margins stood at 12.9% Vs 13.2% in 9MFY24. During the quarter, company opened up 7 new stores taking the total EBO count to 410. Cumulatively, for 9MFY25, RLXF opened up 11 new EBOs.

Our View

The performance in Q3FY25 was below our estimates by 8%/12%/22% on Revenue/EBITDA/PAT front respectively. Consequently, we have revised our estimates for FY25E/FY26E/FY27E downwards. Going ahead, we expect Volume/ASP growth of 3%/4% respectively over FY24-FY27E which should lead to revenue growth of 7% over similar period. With better realizations, we reckon operating margins to improve gradually to 13.1% over FY26E-FY27E respectively. We have revised our EPS estimate downwards for FY25E/FY26E/FY27E by 28%/19%/15% respectively, largely owing to lower volume growth Vs earlier expectations. On account of lower growth expectations, we have revalued the company at P/E(x) of 50x on FY27E EPS, arriving at a target price of Rs473. Hence, we retain our SELL rating on the stock.

Result Highlights

* Volumes declined by 15%YoY to 40Mn pair, (2-year CAGR stood flattish). ASP improved by 10%YoY over similar period to Rs167/pair.

* Revenue for the quarter stood at Rs6.67Bn, a degrowth of 6.4%YoY & 2%QoQ.

* Operating margins came in at 12.5% Vs 12.2%/12.9% in Q3FY24/Q2FY25 respectively, which was below our est by 50bps & 80bps below consensus est. EBITDA stood at Rs834Mn, a decline of 4%YoY & 5%QoQ.

* Net profit stood at Rs330Mn, a degrowth of 14.4%YoY and 10%QoQ.

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632

.jpg)