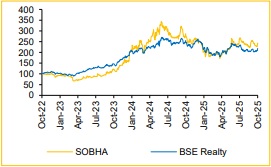

Buy Sobha Ltd for the Target Rs. 1,840 by Choice Institutional Equities

Healthy Mix of Launches and Project Completions

We maintain our BUY rating on SOBHA with a TP of INR 1,840/sh (1,800/sh earlier). We expect FY26 and FY27 to be a be a launch heavy year which will drive healthy pre-sales growth and revenue recognition of 4 msf worth of deliveries in FY26/27 would materially lift reported financials. EBITDA margins (reported) would gradually move up as higher priced and higher margin projects start getting completed and get recognised in the reported financials.

Pre-sales decreased 6% in FY25 which worried the market, but FY26 to be a launch heavy year:

SOBHA’s pre-sales declined in FY25 owing to approval delays; however, the company expects a sharp rebound with 35% YoY growth in FY26 to INR 85Bn and aims to achieve INR 100Bn in pre-sales by FY27E. SOBHA plans to launch 8 – 9 msf of projects in FY26E. From its ongoing and completed projects, SOBHA expects to generate net cash flows of INR 111Bn over the next 4–5 years, while future projects are projected to yield INR 70.0Bn over the next 5–6 years from 18 msf of planned launches.

Expanding into new geographies:

SOBHA is slowly and gradually expanding its presence beyond the Southern market, as it is not in a hurry to increase its inventory within a short span of time. SOBHA has already made an impressive start in the NCR region and also started investing in new geographies like Pune and Hyderabad and increasing its presence in Kerala. SOBHA also has plans to penetrate into the MMR market, although it is at a nascent stage.

Rights issue of INR 20Bn to support future growth:

SOBHA has raised INR 20Bn through rights issue, which will be used for funding certain project-related expenses for ongoing and forthcoming projects, capex, acquisition of land parcels and partial debt payment. Despite higher land prices across Tier-I and Tier II cities, we believe SOBHA has the execution wherewithal to generate over 30% project-level EBITDA.

Valuation:

Based on the SOTP valuation approach, we arrive at a target price of INR 1,840, factoring in the Residential Business, Commercial Rental, Contract & Manufacturing Business, as well as the land bank.

Risks:

A broad-based slowdown in the domestic economy and delay due to legal and regulatory issues.

Quarterly Performance

* SOBHA reported Q2FY26 Pre-sales at INR 19.0Bn, up 61.4% YoY and down 8.5% QoQ. This was a strong performance in a seasonally weak quarter.

* Collections increased 30.3% YoY and 0.8% QoQ to INR 17.9Bn.

* SOBHA launched an extension of its boutique luxury villa project, SOBHA Lifestyle, which is 2.12-acre development in North Bengaluru.

Management Call - Highlights

Macro Environment:

* SOBHA saw steady demand for luxury real estate, supported by improving macroeconomic conditions and government interventions.

* The inflationary environment was challenging during 2021 – 2024, but has stabilized in the past year.

* Consumer demand remains strong, particularly in the INR 20 – 30 Mn ticket size segment.

* Price growth has moderated from previous years as demand and supply have reached a more balanced level.

Operations:

* SOBHA had slower launches in H1FY26 due to external and internal issues, but aims to launch 8 – 9 msf feet across 7 – 8 projects in FY26.

* SOBHA Magnus in South Bangalore is being launched in Q3 FY26

* The robust development pipeline compromises of 15.96 msf across 13 residential projects in 9 cities and 0.74 msf of commercial projects slated for launch over the next 4 – 6 quarters. An additional 24 msf is planned in subsequent project phases.

* SOBHA plans to launch its first Mumbai project in H2FY26 and 3 NCR projects totaling ~3.5 msf are planned for H2FY26.

Pricing:

* SOBHA has seen good price increases in Bangalore over the past 2 – 3 years due to demand-supply dynamics but expects more stable/inflationary increases going forward.

* Value growth has come primarily through price increases and changes in project mix rather than volume growth.

* SOBHA takes price increases quickly when needed to protect margins from cost increases.

Guidance:

* Management has reiterated its pre-sales guidance of INR 85Bn for FY26, while expressing confidence in potentially surpassing this target.

* SOBHA aims to complete 5.5 msf feet in FY26E

* For margins, management expects to move from current 20% gross margins toward 30% in FY27E, though exact estimates are not yet finalized.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131