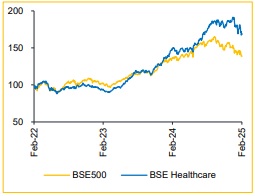

Pharmaceutical & Healthcare Sector Update : Companies outperform IPM; US pricing pressure persists amid global growth by Choice Broking Ltd

Companies outperform IPM; US pricing pressure persists amid global growth:

Pharma companies in our coverage outpaced the Indian Pharmaceutical Market (IPM), growing at an average of 12.4% YoY compared to the IPM's 8.3% YoY growth. This success is attributed to the strategic focus on key therapeutic areas like VMN, Diabetes, Neurology, etc. However, global markets present challenges, particularly in the US, where pricing pressures and generic competition impact sales of drugs like Lenalidomide/gRevlimid (DRRD, SUNP, and CIPLA). Conversely, European markets are seeing growth due to new launches, and Asian markets are strengthening in branded generics.

Among top performers, GNP (35.1% YoY), DIVI (25.0% YoY), and LAURUS (18.4% YoY) led the revenue growth. We anticipate that these companies will continue to outperform broader industry levels, fueled by ongoing new product launches and an enhanced product mix.

Shift to specialty products and complex generics fuels margin expansion: Strategic shifts toward high-margin products and segments are evident among companies in our coverage. Focus areas include specialty products, complex generics, and CDMO services aimed at improving profitability. Notable product launches from SUNP, CIPLA, DRRD, and LPC, such as Semaglutide (Type 2 Diabetes, market size: USD 100Bn) and GLP-1 (Type 2 Diabetes and obesity, market size: USD 3.7Bn), are expected to enhance margins.

On average, companies in our coverage have seen a 25.3% YoY growth in EBITDA, with margin expansion of 266bps YoY. Key players include GNP (+2604bps YoY) and DIVI (+568bps YoY). We expect margins to improve as operational leverage kicks in and focus on high-margin products.

Focus on biosimilars with strong market opportunities: In Q3FY25, biosimilars emerged as a significant area of focus for several pharmaceutical companies, with strategic launches and development plans in place. Companies like DRRD, LPC, and ZYDUSLIF are advancing their product pipelines, with drugs with impressive market sizes: Denosumab (USD 3.3Bn) (DRRD), Etanercept (USD 18Bn) (CIPLA, LPC), and Rituximab (USD 5.1Bn) (DRRD). To leverage the growing opportunities in these segments, these companies are directing R&D investments towards the development of complex generics and biosimilars.

Growth in branded generics and stabilization in API pricing signal positive trends: Branded generics demonstrated strong double-digit growth in several markets, bolstered by a robust product pipeline and increasing market share. In contrast, the generics segment experienced some pricing pressure, but demand is anticipated to rise. However, API pricing pressures have stabilized, and demand is expected to improve, positioning the sector for better performance moving forward.

Trump Reciprocal Tariffs: Indian companies are global leaders in cost-effective manufacturing and innovation, with pharmaceutical exports to the US contributing 30%-50% of revenues for top drug makers. They supply 45% of the US generic drug market, ensuring affordable healthcare. If a 25% tariff is imposed, it could erode $ 2.25Bn (25% of $ 8.5Bn) in value for Indian exporters. While some Indian companies have US manufacturing facilities, their scale is too small to offset the impact. Relocating production to the US is not financially viable, and if manufacturers cannot pass the tariffs onto consumers or distributors, profitability could be significantly affected across the industry and some companies may stop serving US. We don not expect this bear case to play out as it’s greatly unfavorable to the US. From our coverage universe, GRAN, DRRD, MRKS, ZYDUSLIF, and SUNP have strong presence in the US.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

Tag News

Cipla gains on the BSE

More News

Metals & Mining Sector Update : On the road in China ? Fresh learnings By Emkay Global Fina...