Oil & Gas Sector Update : Refining, Not a beautiful sunset, but a few hues remain by Prabhudas Lilladher Capital Ltd

Rising uncertainties in global trade and geopolitics have further solidified the importance of protectionism in a strategic sector like refining. National oil companies (NOCs) dominate the global refining sector with 54% market share. Global demand for petroleum products is fading with call on refined products almost flat at 85.9mnbopd in 2030 vs 85.6mnbopd in 2024. This situation would normally call for capacity rationalization. However, the rush to secure domestic availability is expected to lead to expansion of global capacity by 2.6mnbopd through 2030, net of closures of 1.6mnbopd. Almost all of the additions are by NOCs, as per our research, and the additions are likely to keep refining margins under check.

* Demand unlikely to grow: Global penetration of EVs in cars has already reached 22% of new sales in 2024. Electrification, although with hiccups at times, is expected to wipe away 5mnbopd of oil demand. Other factors like the Middle East shifting from oil to gas for power generation, rising fuel efficiencies globally, and adoption of biofuels, coal-to-liquids (CTLs) and gasto-liquids (GTLs), among others, are likely to keep demand for refined products under check at 85.9mnbopd in 2030 vs 85.6mnbopd in 2024.

* Strategic interests rather than economics behind expansions: Net capacity addition of 1.6mnbopd, combined with poor growth in demand, is likely to lower global refining capacity utilization to 77% in 2030 compared with 78% in 2024. While capacity growth does not make sense in a sunset industry, it may be noted that almost all of 3.9mnbopd major refining capacity additions that we have enumerated are by NOCs, primarily driven by non-economic strategic considerations.

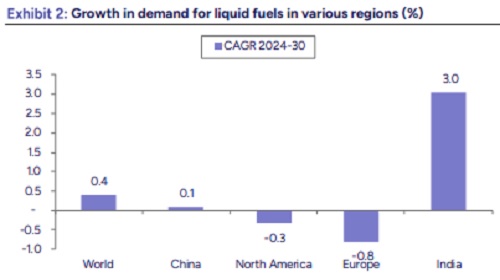

* Petrol, diesel cracks to be hit the most: Petrol, diesel and kero/ATF are the only products with positive crack spreads. Typical yield of a refinery would contain 15-20% of petrol, 40-50% of diesel, and 5-7% of kero/ATF. While global demand for liquid fuels is projected to increase at 0.4% CAGR during 2024-30, it may be noted that petrol is expected to witness decline of 0.6% CAGR and diesel is unlikely to grow. Against these, kero/ATF is likely to grow at CAGR of 2.1%. At best, we expect GRMs to gravitate toward long-term average of USD5-7/bbl against the normally expected “golden age of refining” suggested by a few experts.

* Marketing margins to the rescue: While SG GRM is unlikely to offer respite, other factors like discount on import of Russian crude and, more importantly, gross marketing margins (GMMs) on petrol and diesel have been supporting oil marketing companies (OMCs). OMCs have made GMM of Rs11.7/9.4/liter on petrol/diesel in FY26YTD against normalized GMM of Rs3-3.5/liter that they used to make earlier. We estimate that loss of USD1/bbl in GRM would require incremental Rs0.7/0.6/0.4/lit of GMM on petrol/diesel for IOCL/BPCL and HPCL respectively. We further estimate that every Rs50/cyl loss on LPG can be compensated by Rs0.7/0.7/0.8/lit incremental GMM on petrol/diesel for IOCL/BPCL/HPCL respectively.

* Valuation and recommendation: We reiterate our Accumulate rating on RIL, primarily driven by the prospects of New Energy, with a target price of Rs1,555. We reiterate our Accumulate rating on MRPL with a target price of Rs152 considering the near-term strength in refining and its foray into chemicals. We reiterate our Sell rating on HPCL and Reduce on BPCL and IOCL. However, we also highlight that if marketing margins were to strengthen, 11-23% market cap expansion could take place through net debt reduction, ceteris paribus.

Above views are of the author and not of the website kindly read disclaimer

More News

Building Materials Sector Update : Demand Softness Persists; Margins Offer Cushion by Prabhu...