Can Safari be the "Indigo" of luggage industry? by Prabhudas Lilladher Ltd

Indigo is the undisputed leader of Indian skies with a market share of 64.5% during Jan-Oct 2025. Air India had a market share of 26.7% during the same period and is on a path of revival after being taken over by Tata’s. Further, Akasa Air is a serious player (market share of 5.1% during Jan-Oct 2025) while SpiceJet has always found ways to stay afloat. Sensing it would be difficult to make further in-roads in domestic market, Indigo chose the path of premiumization (focusing on business class) and long haul (entry into international markets) quite early to stay ahead of the curve.

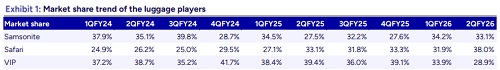

We believe Safari is in a similar position like Indigo where it will have to think ahead of time if it intends to be at a clear pole position in the luggage industry. First, let us have a look at the market share table below and then we will explain why Safari needs to get its act together now to emerge as a clear market leader.

As can be seen, the market share of Safari has increased from 24.9% in 1QFY24 to 38.0% in 2QFY26. However, we believe, days of easy gains in market share are over as there has been a change of guard at VIP. Further, after registering de-growth in top-line for 6 quarters, Samsonite India finally reported an 8.5% YoY constant currency growth in 2QFY26, indicating early signs of revival. With the other two players pulling their socks, and growing prevalence of new age brands, Safari will have to think out of the box to emerge as a clear leader

What strategies can Safari adopt to emerge as a distinct market leader?

Similar to Indigo, Safari, can opt for:-

* Premiumization

* Geographical diversification (Enter new markets) In fact, Safari has already entered premium segment with brands like Urban Jungle and Safari Select. As of 2QFY26, both these brands contributed ~5% to the top-line. However, as these brands are self-incubated, they would take time to evolve as a preferred consumer choice. We thus believe acquisition can be the best option to scale quickly in the premium segment. There are a lot of new age D2C brands providing enough inorganic opportunity. Acquiring a well-established brand can shorten the journey of premiumization. While acquisition could be a solution to premiumization, entry into new geography is a very difficult proposition. Some of the challenges and potential solutions are highlighted below:-

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271

Tag News

Sensex, Nifty end flat after 2-day rally

More News

Quote on Market Morning inputs by Shrikant Chouhan, Head Equity Research, Kotak Securities