IT Sector Update : CTSH outperforming peers, gaining ground in large deals by Kotak Institutional Equities

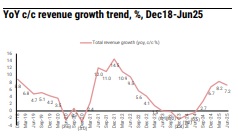

CTSH reported c/c revenue growth of 7.2% for the June 2025 quarter, above the guided range, led by strong growth in financial services. The growth rate has now converged with/exceeded peer growth rates. Deal TCV was impressive, with two US$1 bn+ deals signed in the quarter. The company has tightened its CY2025 revenue growth guidance range to 4-6% (3.5-6% earlier). Read-through for the rest—CTSH has started gaining wallet share in a few verticals and has emerged as a formidable player in large deals.

Another good quarter; growth exceeds top end of guidance range again

CTSH delivered revenues of US$5,245 mn, representing growth of 8.1% yoy and 2.5% qoq. Growth in c/c stood at 7.2% yoy above the guided range of 5-6.5%. Acquisitions contributed 400 bps to growth, implying organic revenue growth of 3.2%, ahead of several peers. Revenue growth was led by the financial services vertical (6% yoy in c/c). Healthcare was soft qoq, though still strong at 5.3% on yoy comparison, with growth coming in far ahead of peers. Product and resources grew 14.7% in c/c yoy and declined 1.3% on an organic basis, while communication, media and technology (CMT) grew 2.2% in c/c. EBIT margin of 15.6% increased 40 bps yoy and was led by an increase in utilization and SG&A leverage. Adjusted EPS of US$1.31 grew 12% yoy.

Marginal increase in CY2025 revenue growth guidance

CTSH increased CY2025 revenue growth guidance to 4-6% from 3.5-6%. The guidance assumes 250 bps from acquisitions, with organic revenue growth guidance at 1.5-3.5%. The guidance’s lower end assumes further macro deterioration; the midpoint factors in deterioration so far, offset by improved deal pipeline, while the upper end assumes some improvement, further supported by large deals.

For the September 2025 quarter, CTSH has guided for revenues of US$5.27- 5.35 bn, implying 3-5% yoy growth in c/c and 1-3% organically. This translates to 0.5-2.0% qoq growth in USD terms, with slightly lower growth in c/c. For 4QCY25, the guidance implies a sequential range of -4% to +1%. The company also raised its EPS guidance to US$5.08-5.22, up from US$4.98-5.14, factoring in the USD depreciation against other currencies and strong operational performance.

Strong bookings with two deals above US$1 bn+ TCV

Bookings rebounded strongly in 2QCY25, growing 18% yoy, with ttm bookings up 6% yoy. CTSH signed two deals above US$1 bn TCV, both with a meaningful net new component—one in the healthcare vertical and the other in CMT. CTSH has significantly stepped up its game in large and mega-deals, a notable shift from its earlier absence in this space. These deals are cost take-out driven, a trend expected to continue through the year.

Read-through for the sector

CTSH has delivered an impressive rebound in growth, now outpacing peers and reflecting improved execution. Wallet share gains are visible in the healthcare vertical, which grew 5.5% yoy, despite being weak qoq—while all major peers reported yoy revenue declines in the same vertical during the quarter.

company has significantly upped its game in mega-deals, emerging as a formidable competitor. In fact, CTSH has closed more mega-deals in CY2025 than the top three players combined, underscoring the progress in its turnaround journey under the leadership of Ravi Kumar

Historically, CTSH was an easy target for market share gains by India-listed players. That is no longer the case, with CTSH now demonstrating its own share gains. Competitive intensity has risen across the sector, especially during a phase of industry-wide growth slowdown, which is a concern.

The stock trades at an inexpensive ~14X CY2025E EPS, offering potential value if execution sustains.

Growth decelerates in the healthcare vertical but still above select peers

Revenue growth decelerated to 5.3% from 11.4% in the previous quarter, possibly due to lower contribution from the ramp-up of previous large deals and muted discretionary spending trends. The payer segment faces further risks to discretionary spending due to cuts in Medicaid funding, while the life sciences segment also faces pressure from uncertainty over tariffs. Headwinds in the vertical will be across industry and could be more pronounced for those with higher exposure to the payer segment. These need to be offset by large cost take-out deals. Payers will likely be willing to offshore more work to lower-cost locations and use automation/AI to save costs, which can be tapped by service providers. Note that CTSH has already indicated a mega deal win in the healthcare segment in 2QCY25, which is likely with a payer client, in our view.

Takes a proactive approach to leverage AI for market share gains

The CEO believes that AI can lead to significant productivity gains in software development. CTSH intends to proactively infuse AI into software development to save costs and pass on savings to clients. Revenue deflation in existing business can be more than offset by gaining share from peers who are reluctant to do so. CTSH also wants to be a front-runner in innovation programs driven by AI and intends to capitalize on the agentic AI trend through partnerships and leveraging internal IP. Furthermore, the company has announced the launch of AI training data services to broader G-2000 clients from a focus on technology companies earlier to capture new revenue opportunities in BPO.

Above views are of the author and not of the website kindly read disclaimer