Energy Sector Update : ALMM for cell delayed, 2027/28 EPS cut likely by Kotak Institutional Equities

The Indian government on July 28 released an amendment to its ALMM list II notification, effectively delaying its implementation by altering the cut-off date for applicability from December 9, 2024 (earlier version), to one month from ALMM list II’s publication. This effectively shrinks the solar DCR market by 40-50% from June 1, 2026, to March 31, 2027, at minimum, since ALMM list II will only be applicable for solar rooftop, PM KUSUM and open access solar projects (cumulative ~60% share of FY2025 solar addition). We believe in the best case, 2027E EPS will reduce by 24.6% for Premier and 15.7% for Waaree, with limited impact in 2028. We have not yet factored in the impact on our estimates, as we await clarification from respective managements.

New amendment to delay implementation of ALMM list II by 9 months+

There has been a significant change in the ALMM list II notification released on December 9, 2024. According to the latest amendment (link), all solar projects (excluding solar rooftop, PM KUSUM and open access RE) would only be mandated to use ALMM list II solar cells, if the bid submission is after the cutoff date. This date has been defined as exactly one month from the publication of ALMM list II for solar cells. This is a significant departure from the previous notification that defined the cut-off date as December 9, 2024 (date of issuance of order), and implies that the government has effectively delayed implementation by a minimum of nine months (assuming ALMM list II is released today, the cut-off day will be August 30, 2025).

IPP to benefit, while solar manufacturers to come under pressure

Since modules make up nearly 50% of the project cost, IPPs that have won solar power project bids since December 9, 2024, and have signed PPAs are likely to benefit from lower raw material costs. On the other hand, the said amendment is negative for solar manufacturers, as it would likely lead to lower DCR module and cell realization in FY2027 and FY2028, since demand will be delayed by nearly a year while solar cell capacity is quickly ramping up.

DCR module and cell demand to nearly halve in FY2027

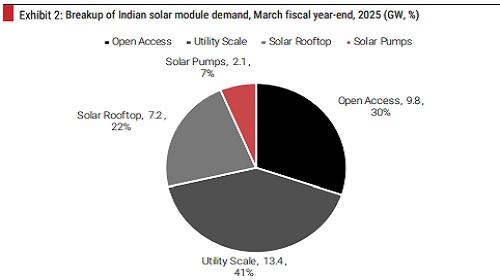

According to the new amendment utility scale, solar power plants, excluding open access and net metering, will not require ALMM list II cells at least up to end-FY2027. Based on FY2025 solar capacity addition, such projects accounted for 10 GW of the total 23.8 GW, implying nearly 40% of demand. According to our estimate, this implies that the total market for solar cells from June 1, 2026, to March 2027/December 2027 (depending on ALMM list II’s release date) will nearly halve—likely to negatively impact DCR module and cell realizations, and in turn, profitability of solar manufacturers such as Waaree and Premier.

2027E EPS to contract by 24.6%/15.7% for Premier/Waaree

We estimate that in the best case (cut-off date: September 1, 2025), the 2027E EPS will reduce by 24.6%/15.7% for Premier/Waaree, with limited impact in 2028. We have not yet factored in the impact on our estimates, as we await clarification from respective managements.

Above views are of the author and not of the website kindly read disclaimer

Tag News

Realty Sector Update :Developers, Flexible Office Space and Construction by Choice Institut...