Accumulate Deepak Nitrite Ltd For Target Rs. 1,858 By Elara Capital

Resilient quarter amid pricing pressure

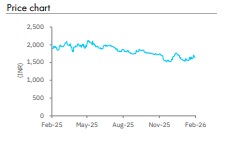

The stock price of Deepak Nitrite (DN IN) has fallen 6% in the past three months and underperformed the benchmark Nifty Mid -Cap Index ( down 2 %), due to a delay in commissioning of nitric acid and Methyl Isobutyl Ketone (MIBK ) & Methyl Isobutyl Carbinol (MIBC ) plants , and pricing pressure from China’s oversupply. DN delivered a steady Q3FY26 performance despite continued pricing pressure. Consolidated revenue and EBITDA grew 4% & 25% YoY, respectively , supported by improved phenolics volume. Management reiterated Q3 reflected a transitional phase, with profit taking a hit by temporary integration mismatches in advanced intermediates (AI) , which should normalize from Q4. We expect improvement in Q4FY26, led by normalization of AI cost, and higher utilization of recently commi ssioned projects . While China -led pricing pressure risk remains, DN ’s strategy of integration and new product expansion positions it well for margin recovery in FY27. Based on 9MFY26 earning trend and visibility emerging on new projects commissioning and ramp - up, we raise our EBITDA by 2% for FY26E, 4% for FY27E and 4% for FY28E . We raise our TP to INR 1,858 as we rollover to FY28 estimates. We reiterate Accumulate

Phenolics stable, while AI segment at trough margin: The p henolics segment remain s resilient, with revenue stable YoY at INR 13bn despite softer realization, led by higher sales volume. The AI segment saw revenue growth of 18% YoY from volume expansion and new geographies, but EBIT margin at 2.3% (vs 3.1% in Q3FY25) remains weak , as aggressive Chin a pricing and delayed captive nitric acid commissioning led to elevated input costs.

Integration & new projects ramp-up – key margin normalization levers from Q4FY26: The commissioning of the nitric acid plant in mid -December, completing DN ’s vertical integration across the ammonia – nitration – amines chain. Management expects near -full internal consumption from Q4, removing reliance on spot nitric acid purchases , thereby improving AI cost competitiveness. Nitration and hydrogenation assets at Dahej are likely to operate at high utilization levels, with integration benefits gradually flowing.

MIBK & MIBC and downstream derivatives to drive FY27 earnings buildup: The MIBK and MIBC project is targeted for commissioning in Q4 with ramp -up expected via FY27. The company continues to scale fluorination, chlorination, and other specialty intermediate platforms, supported by customer diversification and new product introductions across end - markets , such as pharma, personal care, and performance chemicals.

Reiterate Accumulate with a higher TP of INR 1,858: Based on 9MFY26 earning s trend and visibility emerging on new projects commissioning and ramp -up, we raise our EBITDA by 2% for FY26E, 4% for FY27E, and 4% for FY28E. We raise our TP to INR 1,858 from INR 1,762 as we rollover TP to FY28 estimates . Our DCF -based TP assumes 5% (unchanged) terminal growth, an 11.0% (unchanged) WACC and an EBITDA CAGR of 7% (from 5% ) during FY25 -30E . We reiterate Accumulate, led by benefits from the commissioning of new projec ts, but near - term ear n ing s performance would be contingent to phenolics and acetone oversupply by China .

Please refer disclaimer at Report

SEBI Registration number is INH000000933