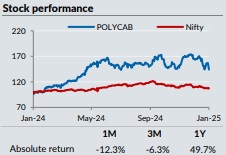

Buy Polycab India Ltd Ltd For Target Rs. 7,502 By Yes Securities Ltd

Enhanced capacities and exports to drive industry leading growth

Result Synopsis

Polycab performance has been mixed bag with revenue marginally missing the estimates by 3%, while margins were 178bps higher than estimates. Revenue grew 20% on yoy basis, with wires and cables, FMEG and EPC segment growing by 12%, 42% and 101% respectively. Margins expansion is on back of 1) mix becoming favorable with Cables proportion being northward of 75%; 2) lower losses in FMEG segment and 3) Steady margin in EPC segment. Growth in its key segment of wires and cables was muted as high channel inventory at the start of the quarter and volatility in copper prices during Q3 impacted wires growth. On the other hand, FMEG segment has seen strong performance aided by festive season and strategic initiatives undertaken by the company resulting in robust growth across product categories. EPC segment continues to see strong growth led from execution from government’s RDSS scheme and has Rs48bn orders in hand to be executed in next couple of years. POLYCAB has initiated project spring where it is looking to grow at ~1.5x to that of wires and cables industry with stable margins, while on the FMEG side it is expected to grow ~1.5-2x of the industry with EBITDA margin of 8-10%. The company is confident of strong demand to continue given the buoyancy in the real-estate, with infrastructure spends (Both government and private capex) expected to pick up again as some key states’ elections have been done with.

We expect strong growth momentum to continue especially in its core category of wires and cables as continued capex, increased in real-estate constriction and exports opportunity will benefit company immensely. Also, FMEG segment should start to pose double digit growth on sustainable basis as re-structuring is behind. We estimate the company to now deliver FY24- 27E revenue of 19%. We have trimmed down the margin expectation given the change in business mix, increased competition, and volatility in copper prices. We continue to maintain our target multiple to 40x as we see strong demand for wires and cables to continue and margins continue to remain higher than the management guidance. We upgrade the stock to BUY with PT of Rs7,502. Current stock correction provides good entry point to enter the stock.

Result Highlights

* Quarter summary – Polycab has marginally missed on revenue growth as wires growth was impacted on de-stocking owing to volatility in copper prices.

* Margins- EBITDA margin at 13.8% was higher than estimates as business mix was favorable more towards cables, while company was able to bring down losses in the FMEG segment.

* Exports- The Exports business delivered strong performance, registering 62% YoY growth, and contributing 8.3% to overall top-line. Company has guided that exports will continue to grow faster than the domestic growth.

* Project Spring –The company has initiated project spring, where it aims at growing Domestic W&C revenue at 1.5x to that of industry growth. The company is envisaging FMEG growth to ~1.5x-2x of the industry with EBITDA margin of 8-10%.

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632