Buy Lumax Auto Technologies Ltd for the Target Rs. 1,330 by Choice Institutional Equities

Business overview:

LMAX, a part of Lumax-DK Jain Group, has 40 years of automotive component manufacturing experience in India. The company operates 26 facilities in 6 Indian states, supported by 2 engineering centres and international design centres in Taiwan and the Czech Republic. LMAX serves major OEMs with a diversified product portfolio including lighting, interior systems, electronics and alternative fuel components. In Q1FY26, LMAX reported revenue of INR 10,264 Mn with an EBITDA Margin of 12.2%. Revenue is expected to expand at a CAGR of 17.7% over FY25–28E, powered by increased JV wallet share and growing scale in high-value segments.

What is the impact of IAC India’s complete acquisition on LMAX’s growth?

LMAX acquisition of the remaining 25% stake in IAC India for INR 2,210 Mn has made it a wholly-owned subsidiary. IAC contributed around INR 3,170 Mn to LMAX’s revenue in Q1FY26. The acquisition will reduce minority interest in LMAX’s consolidated earnings, from ~23% in FY25 to 15% FY27E onwards, enhancing PAT for its shareholders. The company is exploring IAC’s legal merger into the standalone entity so as to streamline operations and drive synergies. IAC’s INR 8,000 Mn order book and exclusive supply role for Mahindra’s BEV models (BE6, XUV 9e) strengthen its positioning in high-value interior systems and the EV segment. We expect this acquisition to significantly improve free cash flow and provide leverage for future inorganic growth by FY27E.

What will drive LMAX’s revenue and profitability growth through FY28E?

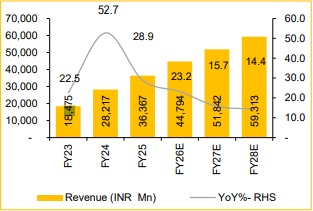

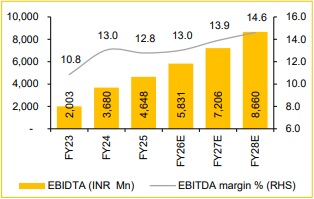

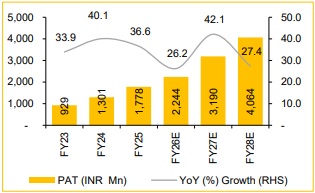

We expect LMAX to grow INR 36,367 Mn in FY25 to approximately INR 59,313 Mn by FY28E, supported by new product launches, higher content per vehicle and deeper OEM penetration. In addition, the company plans 1–2 strategic acquisitions in lightweighting and export-oriented segments, following its approach of acquiring majority stakes (typically over 60%) while retaining operational independence of acquired firms. Strategic partnerships with global players, such as Alps Alpine (infotainment systems) and Yokowo (connected vehicle antennas), will drive technology-led expansion. On the profitability front, we expect APAT to grow from INR 1,778 Mn in FY25 to INR 4,064 Mn in FY28E, supported by margin expansion, increased JV wallet share and growing scale in high-value segments.

What makes LMAX a standout investment in India's automobile industry?

LMAX stands out in India's automobile industry owing to its robust financial performance, with consolidated revenue at INR 10,264 Mn and a 30.7% YoY profit increase in Q1FY26. The company’s aggressive growth strategy – driven by strategic acquisitions, such as Greenfuel in the CNG fuels space and the full consolidation of IAC India – positions it at the forefront of emerging mobility solutions. LMAX’s expanding product portfolio, focus on R&D and rapid capacity additions enable it to capitalise on the shift towards EVs and CNG vehicles. Its diversified client base and consistent double-digit growth prove market dominance. With ongoing investments in technology and a clear roadmap for margin expansion, LMAX is well-placed for sustained outperformance and value creation.

Recommendation:

We maintain a positive outlook on LMAX, maintaining our ‘BUY’ rating, with a TP of INR 1,330.

Key Risks:

* Cyclical industry exposure: LMAX is highly dependent on the automotive industry which is cyclical in nature. Any possible slowdown in automobile sales or likely supply chain disruption could directly and drastically affect its revenues and profitability.

Revenue expected to grow 17.7% CAGR over FY25–28E

EBITDA Margin to improve over the years

PAT projected to expand 31.7% CAGR over FY25–28E

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131