Accumulate Lupin Ltd For Target Rs.2,447 By Elara Capital

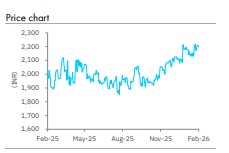

Lupin (LPC IN) reported Q 3FY26 results significantly ahead of our estimates , with revenue and EBITDA high er by 9% and 38%, respectively. The beat primarily comes from continued market exclusivity in gJynarque ( tolvaptan ); competition is yet to enter even though the 180- day exclusivity period is over . Also, gSpiriva and gMyrbetriq (mirabegron) continue to be large contributors to the US business . India business growth at 5.6 % YoY continues to take a hit from the loss of exclusivity in a partnered product. EMEA compensated with ~ 47% YoY growth; it could have benefitted from currency movements as well. EBITDA margin sustained at 30% , helped by tolvaptan. Management ’s raised FY26 EBITDA margin guidance of 27-28% seems too conservative but will likely come off in FY27 . We raise our FY26 -28E core EPS by 13-19% as we build in larger and longer contr ibutions from gJynarque and gMyrbetriq . We retain Accumulate with a higher target price to INR 2, 447

Tolvaptan continues; gSpiriva, gMyrbetriq continue: Tolvaptan, launched with 180 -day market exclusivity, continues to remain s the sole generic in the market despite expiry of the exclusivity period . We e stimate >USD 100mn of high margin tolvaptan sales in Q 3, similar to Q2 levels . We expect additional competition only in Sep tember 2026, given the IP landscape; after that , it will be a staggered entry of players . The recent settlement with Astellas Pharma provides visibility to gMyrbetriq sales continuing un til Sep 2027 . Currently, there is no indication of entry of any competitor in the gSpiriva market.

High base could be challenge to medium-term growth in the US: LPC has a strong pipeline for the US business that includes attractive exclusivity opportunities such as gJuluca and gXywav, inhalation products such as gDulera and gBreo Ellipta, biosimilars such as bNeulasta, bLucentis , bEylea and bEnbrel, and undisclosed novel formulations (505 [b]2). However, these may not be adequate to compensate for the loss of high base formed by gJynarque, gMyrbetriq &gSpiriva in FY27 and FY28. We expect organic US reven ue to be flat next 3 -4 years on FY26 base .

Other markets do well: India business grew just 5.6% growth YoY; excluding the impact of loss of exclusivity in a partnered product , growth was at 10%+. EMEA compensated with ~ 47% YoY growth; depreciation of the INR, especially vs the EUR, could have been a significant contributor . The Semaglutide launch could be a growth driver for all these markets. RoW business growth at 24% YoY was strong as well; again, INR depreciation may have helped .

FY26 Margin guidance looks conservative; likely to dip in the next year: Management raise s FY26 EBITDA margin guidance to 2 7-28% from 2 5-26%. We see this too as conservative and build in 29%. However, this will likely come off in FY27 once gJynarque sales wane s

Retain Accumulate with a higher TP of INR 2,447: We raise our FY26 -28E core EPS by 13-19%. LPC trades at 2 3x FY27E core earnings. We raise our target price to INR 2, 447 which is on 25.0x FY2 8E core earnings plus cash per share. We retain Accumulate. Competition in gSpiriva and g Jynarque are key risks.

Please refer disclaimer at Report

SEBI Registration number is INH000000933