Reduce Gujarat Fluorochemicals Ltd For Target Rs. 3,780 By JM Financial Services Ltd

PTFE anti-dumping duty to lift fluoropolymers outlook

The Directorate General of Trade Remedies (DGTR) has recommended imposition of antidumping duty (ADD) on PTFE imported into India, especially from China and Russia, for a period of 5 years. This is likely to majorly benefit Gujarat Fluorochemicals as it holds ~40- 45% market share in the domestic PTFE market, as per our understanding. Of GFL’s overall sales in FY25, PTFE sales accounted for ~30-35% (domestic PTFE sales is ~10% of overall sales). Of the imposed ADD of ~USD 2.8-5.9/kg, we expect benefit of USD 3.0-3.5/kg for GFL. This is likely to result in a benefit of INR 0.8bn-1.0bn in FY27-28, translating into 3- 4%/4-7% upward revision in our current EBITDA/EPS estimates. We, however, have not considered any impact from the recent fire incident at one of the company’s plants. This, along with any delay in ramp-up of EV battery chemicals are key downside risks to our estimates. We change our rating from Hold in our previous rating system to REDUCE in the new rating system.

* ADD on PTFE for a period 5 years: DGTR has recommended imposition of ADD on PTFE imported into India, especially from China and Russia, for a period of 5 years. ADD on PTFE imports (except from Chemours and Zhonghao) will be ~USD 2.8-5.9/kg (refer Exhibit 1), depending on the country and manufacturer. India imported ~4.5KT of PTFE (of which ~3.6KT was from China and Russia) in FY24 (refer Exhibit 2).

* GFL, which holds 40-45% share in domestic PTFE market of~9.5-10.5KTPA, to benefit: GFL has PTFE capacity of ~24,000MTPA. As per our understanding, in FY25 its PTFE capacity utilisation was ~70-72%, taking the total sales volume to ~17-18KTPA. Of the total sales volume, GFL’s domestic sales volume is likely to have been ~20-25%, or ~3.5- 4.5KTPA. Besides this, SRF has PTFE capacity of ~5KTPA, which operated at ~50% utilisation. In our view, SRF’s domestic sales were around ~1.4-1.8KT in FY25. Hence, the domestic PTFE market comes out to ~9.5-10.5KTPA (~4.5KTPA imports, ~3.5-4.5KTPA sales of GFL, and ~1.4-1.8 KTPA sales of SRF). Given SRF is in the ramp-up mode, GFL could face competition from SRF in the domestic market. Hence, the benefit of ADD for GFL might not be on the entire volume. Assuming Gujarat Fluorochemicals gets ADD benefit of ~ USD 3-3.5/kg on ~3KTPA of volume, its benefit could be INR 0.8bn-1.0bn.

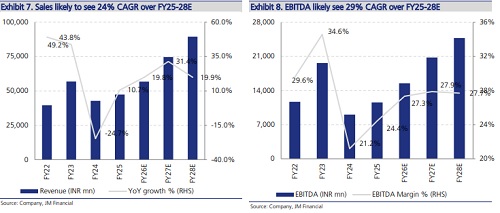

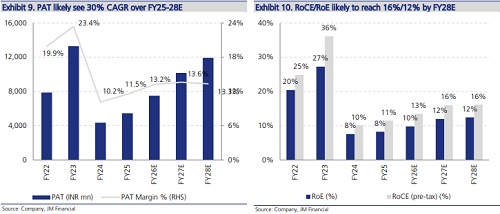

* Revise rating to ‘REDUCE’ as per new rating system with a revised TP of INR 3,780: For GFL, we now bake in EBITDA benefit of ~ INR 380mn/ 880mn/ 1.1bn in FY26E/27E/28E. This translates to upward revision of ~3-4% in our FY26-28 EBITDA estimates and a 4- 7% upward revision to our FY26-28E EPS estimates. We now estimate GFL to register 29%/30% EBITDA/EPS CAGR over FY25-28E. Factoring this in, our SoTP-based Sep’26 TP is revised upwards to INR 3,780 (from INR 3,645 earlier). In FY27-28, we highlight that there is 6%/14% of overall EBITDA baked in from the EV battery chemicals where there could be potential ramp-up delays. This along with any potential delay from the recent fire incident at one of its plants could result in earnings cuts. Hence, we expect the stock to be range-bound in the near term. We change our rating from Hold in our previous rating system to REDUCE in the new rating system.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361