Reduse Gabriel India Ltd For Target Rs. 1,000 By Choice Broking Ltd

Strengthening Core with Strategic Acquisitions and Product Expansion

GABR’s ongoing restructuring is set to significantly strengthen its financial position through the integration of high-margin, growth-oriented businesses with its core operations. The inclusion of Anchemco, along with strategic stakes in Dana Anand, Henkel Anand, and ACYM, is expected to drive meaningful revenue expansion by adding both scale and product diversity with an estimated revenue CAGR of 20.0% from FY25–28. The transaction is expected to be EPS accretive, with an estimated EPS CAGR of 40.6% from FY25–28, even after factoring in equity dilution. This positions GABR to benefit from the continued strong performance of its core businesses: the suspension systems and the recently added sunroof segment.

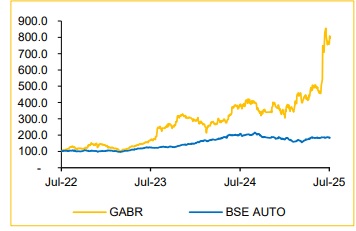

View and valuation: We maintain our FY26, FY27 and FY28 EPS estimates and value the company at 28x (unchanged) of the average FY27/28E EPS. We maintain our target price at INR 1,000 and remain positive on the long term growth story of the company, but given the recent run-up in the stock price, we downgrade the rating to ‘REDUCE’ from ‘ADD’.

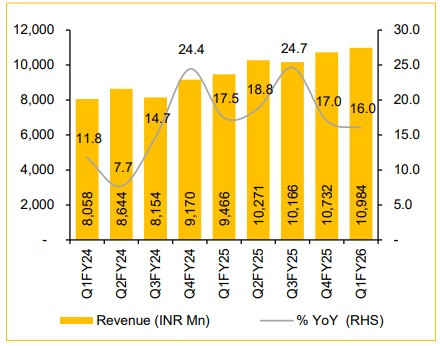

Q1FY26 Revenue and EBITDA inline; PAT better than Expectations

* Revenue was up 16.0% YoY and up 2.4% QoQ to INR 10,984Mn (vs consensus est. at INR 10,574Mn).

* EBITDA was up 16.0% YoY and down 3.2% QoQ to INR 1,053Mn (vs consensus est. at INR 1,013Mn). EBITDA margin was flat YoY and was down 55bps QoQ to 9.6% (vs consensus est. at 9.6%).

* PAT was up 7.6% YoY and down 3.7% QoQ to INR 620Mn (vs consensus est. at INR 565Mn).

Sunroof Business Expansion: The sunroof business is set to double its existing capacity to 400K units per year by H2FY25 within existing facilities, supported by strong demand. Although no new orders were secured during the quarter discussions with other domestic OEMs are in the RFQ (Request for Quote) and advanced discussion stages. Diversification into the sunroof segment, which offers higher EBITDA margins in the range of 12-14% compared to 9% percent for suspension systems, has improved the company’s overall margin profile and reduced its reliance on a single product line.

Strategic restructuring: The restructuring marks a transformational shift for GABR, repositioning it from a single-product suspension manufacturer to a diversified, multi-product mobility solutions provider. We believe this restructuring will significantly boost GABR’s scale, technological capabilities, and customer base, positioning it as a key growth engine for the automotive business, while also enabling direct collaboration with foreign strategic partners for the investment and development of new technologies and products.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

2.jpg)