Buy Ethos Ltd For Target Rs. 3,500 By Emkay Global Financial Services Ltd

Concerns over high WC addressed; reiterate BUY

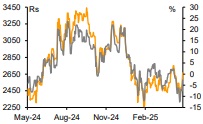

We reiterate BUY on Ethos with revised TP of Rs3,500 (up ~6% on 3M rollover to Jun-26E; earnings/multiple unchanged). We stepped into Ethos’s Q4 concall with apprehensions about the elevated working capital, growth prospects in the wake of a volatile stock market, and sustainability of gross margin (up by 180bps in Q4). However, we came out upbeat on the WC/capex increase being attributed to the upfront payment in sourcing of India-specific models and launch of flagship space City of Times (22,000sqft), housing seven boutiques that opened in May-25 and two to open in Q2. Also, growth outperformance sustains, with strong traction in Apr-25 and healthy pick-up expected in remaining Q1, following a soft May-25TD impacted by geopolitical tensions. While a volatile INR-CHF could impact Q1 gross margin, Ethos has now adopted a 50% hedging policy to mitigate adverse FX-related margin volatility. It reiterated its ambition to scale by 10x in 10 years, led by a multi-fold expansion of new watch retail, growing traction in its new lifestyle vertical (Rimowa), Dubai and India expansion to accelerate CPO growth, and promising optionality in its own brand Favre Leuba. The margin-accretive EFTA agreement is likely to be implemented by CY25-end. While an adverse GST ruling is a margin risk, Ethos is confident of gradually expanding margin with support from brands.

Ethos’s expansion strategy centered around share gains and TAM expansion: To

capture market share in Delhi-NCR, Ethos has launched an expensive luxury space—City of Times (a 22,000sqft space, housing nine boutiques). The chosen boutiques span the entire range of luxury price-points – from Tudor (Rolex) in the premium segment, Bell & Ross/Breitling in the BTL segment, to Panerai/GP/Ulysse in the luxury tier, and H-Moser in the high-luxury category. In addition to mono-brand EBOs, the space also features two multi-brand boutiques, offering over 50 brands across price points. Ethos is also expanding into metro cities like Chennai and tier1/2 cities like Vijayawada /Dehradun, to expand its footprint and gain market share in underpenetrated regions. As the company has seen strong traction in luxury travel with Rimowa, it plans opening more Rimowa stores and expanding its TAM with addition of other luxury lifestyle categories through exclusive partnerships like Messika. Ethos highlighted that unit metrics for Rimowa and Messika are comparable with its new watch retail stores. Overall, Ethos plans to cross the 100-store milestone in FY26 (up from 73 boutiques at FY25-end).

Pre-owned business poised for growth acceleration: The CPO (pre-owned) vertical

is currently seeing ~30% growth, likely poised to accelerate with upcoming service centers in Bengaluru/Mumbai and gradual increase in supply of authenticated watches in India. Ethos is exploring the Dubai market too with local operations (Ficus Trading), to tap the India diaspora-driven retail opportunity (exclusive rights for Favre Leuba) and the booming pre-owned potential in the region. With presence of service centers for most luxury brands, the new subsidiary will also enable better after-sales support, which will help provide a differentiated customer experience in India.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354