Buy Sansera Engineering Ltd For the Target Rs. 1,374 by Choice Broking Ltd

SANSERA Q3FY25 Revenue and EBITDA missed expectations, but PAT aligned with street estimates

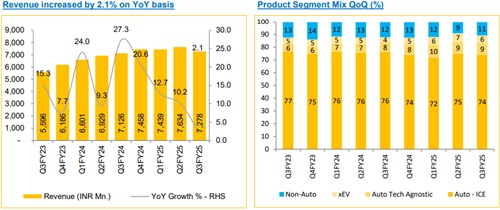

* Consolidated revenue for Q3FY25 stood at INR 7,278Mn, up by 2.1% YoY and down 4.7% QoQ (vs CEBPL estimates of INR 7,983Mn).

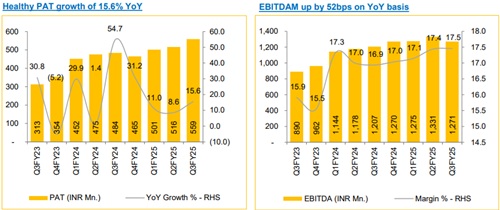

* EBITDA for Q3FY25 was reported at INR 1,271Mn, (vs CEBPL est. INR 1,373Mn), up 5.3% YoY and down 7.55% QoQ. EBITDA margin was up 52bps YoY and 2bps QoQ to 17.5% (vs CEBPL est. at 17.2%).

* PAT for Q3FY25 reported at INR 559Mn, (vs CEBPL est. INR 570Mn), up 9.9% YoY and down 1.3% QoQ

QIP proceeds driving debt reduction and expansion:

SANSERA’s INR 12,000Mn QIP has strengthened its financial position and enabled strategic growth initiatives. The company utilized INR 7,000Mn to reduce debt, significantly improving financial stability and bringing its D/E ratio down from 0.66 to 0.12. An additional INR 2,000Mn has been allocated to capital expenditures, with INR 1,000Mn for land acquisition and INR 1,000Mn for new machinery. The remaining INR 2,750Mn will be deployed for growth capex and other developmental initiatives. With a gross debt of INR 3,500 Mn as of December and a net cash position of INR 1,500 Mn, SANSERA is well-positioned to accelerate expansion and strengthen operational capabilities

Diversification into non-auto sectors de-risking the business

SANSERA is reducing dependence on the automotive sector by expanding into non-auto (off-road, agriculture, aerospace, defense, and semiconductor), xEV, and tech-agnostic segments, which are expected to contribute 38% of revenue in three years, up from 26% currently. The order book stands at INR 22Bn, with over 60% from global markets, while aerospace, defense, and semiconductor orders total INR 6000Mn, with at least 50% execution expected next year

View and Valuation:

We maintain our BUY rating on SANSERA with a revised target price of INR 1,374 (25x FY27E EPS), reflecting a +4.7%/-2.5% adjustment in FY26/27 EPS estimates. The company’s transition to a diversified, xEV-agnostic supplier strengthens long-term growth, supported by rising non-auto revenue, new engineagnostic orders, and export recovery, driving margin expansion

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

.jpg)

.jpg)