Buy Kotak Mahindra Bank Ltd for the Target Rs. 2,500 by Motilal Oswal Financial Services Ltd

PPoP in line; Prudential provisions lead to a slight earnings miss

Asset quality steady; slippages decline QoQ

* Kotak Mahindra Bank (KMB) reported a standalone 4QFY25 PAT of ~INR35.5b (6% miss on MOFSLe), because of higher provisions (to shore up PCR, partly due to AIF provisions of INR560m). Consol. PAT stood at INR49b (5% QoQ growth and 8% YoY decline) in 4QFY25.

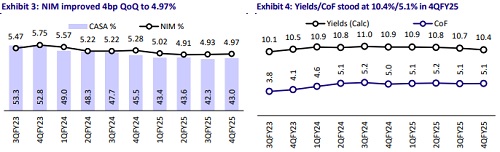

* NII grew 5.4% YoY to INR72.8b (largely in line). NIM expanded 4bp QoQ to 4.97% (MOFSLe: 4.92%).

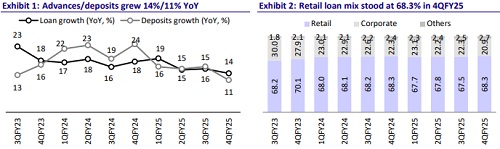

* Advances growth was modest at 13.5% YoY/3.2% QoQ to ~INR4.27t, while deposits rose 11.2% YoY/5.4% QoQ. CASA mix improved 70bp QoQ to 43%.

* Fresh slippages declined 10.2% QoQ to INR14.9b (INR16.6b in 3QFY25 and INR18.7b in 2QFY25). GNPA ratio thus declined by 8bp QoQ to 1.42%, while NNPA declined 10bp QoQ to 0.31%. PCR increased 492bp QoQ to 78.1%.

* We estimate KMB to deliver an FY27E RoA/RoE of 2.1%/13.3%. Reiterate BUY with a TP of INR2,500 (premised on 2.5xFY27E, SoTP of INR770).

Advances growth modest; NIM surprises positively

* KMB reported a standalone PAT of ~INR35.5b (6% miss; down 14% YoY, up 7.5% QoQ) amid higher provisions. Consol. PAT stood at INR49b (5% QoQ growth and 8% YoY decline) in 4QFY25. PAT for FY25 (incl. sale of Kotak general insurance) stands at 164.5b, up 19.4% YoY (ex-KGI at INR137.2b, flat YoY), we expect FY26E PAT at INR152.3b, (up 11% YoY, ex of KGI).

* NII grew 5.4% YoY/1.2% QoQ to INR72.8b (broadly in line). NIM improved 4bp QoQ to 4.97%, benefitting from reduced day count in Feb’25. Other income grew 6.9% YoY/21.3% QoQ to INR31.8b (6% beat), led by healthy fee income.

* Opex grew 12.8% YoY/7.7% QoQ to INR49.9b. C/I ratio thus inched up 48bp QoQ to 47.7%. PPoP stood flat YoY/up 5.6% QoQ to INR54.8b (in line).

* Loan growth was modest at 13.5% YoY/3.2% QoQ, amid a decline in corporate banking as well as credit cards. PL, BL, and consumer loans have picked up significantly after the lifting of the embargo and grew 24% YoY/17% QoQ. Deposit growth gained traction at 5.4% QoQ (up 11.2% YoY). With the heavy lifting done from CA deposits at 10.6% QoQ (5% QoQ in 3QFY25). As a result, CASA improved to 43%, while TD growth also stood healthy at 4.2% QoQ.

* Fresh slippages declined 10.2% QoQ to INR14.9b, with stress continuing in the MFI segment. The GNPA ratio declined to 1.42%, while NNPA dipped 10bp QoQ to 0.31%. PCR increased 492bp QoQ to 78.1%. SMA-2 loans declined to INR1.2b (3bp of loans). CAR/CET-1 stood at 22.2%/21.1%.

* Performance of subsidiaries: Kotak Prime’s net earnings improved 33% YoY, while Kotak Life reported a 33% YoY decline in PAT at INR0.7b. Kotak Securities’ reported PAT declined 7.9% YoY to INR3.5b, while Kotak AMC reported a 143% YoY/52% QoQ increase in PAT to INR3.6b.

Highlights from the management commentary

* The share of unsecured loans declined from 12.7% to 10.5% of total advances. The bank aims to increase this towards the mid-teen range, with a strong focus on credit cards and upcoming product launches.

* PCR has improved to 78%. With the accretion in GNPA slowing down and the new book in unsecured being of better quality, the bank remains confident in its asset quality outlook.

* Advances are expected to surge 1.5-2.0x of nominal GDP, reflecting Kotak’s commitment to building a sustainable, customer-trusted franchise; this momentum is expected to carry into FY26.

Valuation and view: Reiterate BUY with a revised TP of INR2,500

KMB reported a mixed bag with NII being largely in line, while other income stood strong amid better fee income. The bank stepped up the provisioning run rate and raised PCR by ~500bp to 78. Its NIM improved 4bp QoQ to 4.97% amid the benefits from the lower number of days in Feb’25. While FY25 growth remained modest, the bank expects the same to rebound to 1.5-2.0x of nominal GDP growth backed by faster growth in the consumer segment and unsecured loans that should also support the overall yields. KMB’s CA book has been growing at a healthy pace, and the CASA ratio has seen a slight improvement, while the CD ratio has witnessed a mild decline in 4QFY25. The reversal of the ban on card issuance shall revive customer onboarding, which shall result in the protection of yields in the repo cut cycle. We tweak our earnings estimates and estimate KMB to deliver an FY27E RoA/ RoE of 2.1%/13.3%. We reiterate our BUY rating with a TP of INR2,500 (premised on 2.5xFY27E, SoTP of INR770).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412