Buy Five Star Business Finance Ltd For Target Rs. 900 by Motilal Oswal Financial Services Ltd

Near-term stabilization to result in healthy growth ahead

Going through the stabilization phase which could last for 1-2 quarters

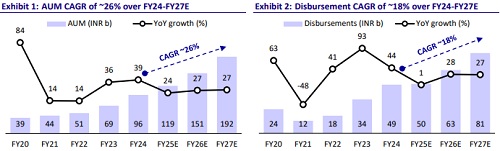

* Five Star Business Finance (FIVESTAR) had calibrated its AUM growth in light of the macroeconomic environment, the overleveraging of certain customers with unsecured loans, and regulatory expectations. FIVESTAR calibrated its disbursements in 3QFY25, and its AUM growth moderated to ~25% YoY as of Dec’24. During Jan-Mar’25, lenders such as FIVESTAR also faced disruptions from the Karnataka ordinance, which may lead to slightly weaker disbursements and AUM growth. We estimate ~24% AUM growth in FY25.

* Given the broad weak macroeconomic environment and disruptions in states like Karnataka, our assessment suggests that the last three and the next three months could very likely be a period of stabilization rather than a period of asset quality improvement. The recent calibration in AUM growth and this period of stabilization in asset quality would create a foundation for stronger growth in the years to come. As conditions improve over the next few quarters, we expect the company to regain business momentum and potentially exceed its current AUM growth guidance of ~25%.

* Our discussions with lenders having a presence in secured lending in Karnataka suggest that the ordinance has had a moderate impact on collections efficiencies (CE), which declined ~3-5% as compared to other states. For FIVESTAR, the overall impact on collection efficiencies will be limited given that Karnataka accounts for only ~6% of the company’s loan mix. With its disciplined risk management and diversified geographical presence, the company remains well-positioned to navigate these nearterm disruptions while staying on course for sustained healthy growth.

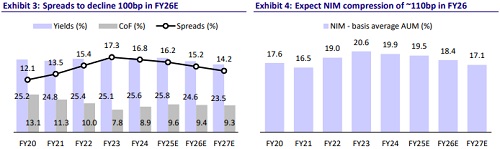

* The company may report near-term compression in NIM following a ~200bp reduction in incremental lending yields since Nov’24. 4QFY25 will be the first quarter in which the full impact of the lower yields will be visible on NIMs. A combination of lower yields and increasing leverage on the balance sheet will lead to some NIM moderation, which could be offset slightly by a gradual dip in its cost of borrowings in a declining rate environment. We project NIMs of 18.4%/17.1% in FY26/FY27 vs. 19.5% in FY25E.

* FIVSTAR has exhibited strong risk management and stringent underwriting standards, consistently driving resilient asset quality and benign credit costs. ~95% of the company’s loan book is secured by SORP, which significantly mitigates credit risk. Its proactive collection strategies have allowed it to deliver relatively superior collections even in adverse external environments since borrowers prioritize repayments of secured loans over unsecured loans.

* With a widespread branch-led distribution network and expansion in new regions, FIVESTAR is set to capture a larger share of the untapped MSME lending space while maintaining its competitive advantage in underwriting and collections. We estimate FIVESTAR to deliver ~26%/19% AUM/PAT CAGR over FY24-FY27 and RoA/RoE of 7.1%/17.4% in FY27. We reiterate our BUY rating on the stock with a TP of INR900 (based on 3.0x Mar’27E BVPS).

Primed for stronger AUM growth in the years ahead

* FIVESTAR does not compete with other NBFCs for market share. Instead, it focuses on customers transitioning from informal money lenders to the formal lending sector, with a major focus on shopkeepers and customers who have not yet accessed formal financing.

* The company had calibrated its AUM growth over the last six months given the macro weakness and the regulatory expectations. Having done that, it is now going through a period of stabilization and is readying itself for stronger growth in the years ahead. We estimate an AUM growth of ~24% in FY25 and an AUM CAGR of ~27% over FY25-27.

Driving growth through geographical expansion

* FIVESTAR aims to drive growth by expanding its customer base rather than relying solely on increasing ticket sizes. Although ticket sizes may rise, this increase will primarily be driven by inflationary factors.

* The company is focused on deepening its presence in southern states through branch expansion while strategically expanding into Western and Central India. FIVESTAR aims to establish a strong foothold in key markets such as MP, Rajasthan, Maharashtra, UP, and Chhattisgarh.

NIM to remain healthy despite a cut in lending yields and higher leverage

* Effective Nov’24, FIVESTAR cut its lending rates on incremental disbursements by ~200bp to 22.5%. This was done to pass on the benefits of its lower borrowing costs to the customers.

* The company's strategic focus on unbanked customers and limited competition in the INR300K-500K ticket-size segment will enable it to sustain robust yields of ~22.5%. Although it has cut yields on incremental disbursements, which will lead to a slight compression in NIM, it is still expected to remain at healthy levels. Management guided a steady-state NIM of ~14-15% and a spread of ~12%. We expect NII as a % of average assets to decline to 15.3%/14.4% in FY26/FY27 (vs. ~16.1% in FY25).

Investments in technology to improve productivity and optimize costs

* FIVESTAR has made significant investments in technology to streamline the lending process, enhance productivity, and optimize its operating cost ratios.

* The company is now leveraging LOS/LMS systems, advanced collection modules, and an efficient customer sourcing module. This transformation has led to notable improvements across loan origination, underwriting, and collections systems. It has reduced TAT to 8-9 days, while a unified platform now offers a holistic view of borrower income and collateral value. Further, income proxies enable comprehensive credit assessment, and the shift to digital collections has improved efficiency in cash handling.

* As a result, the cost-to-income ratio has improved from ~35% in FY23 to ~31% in FY25E, while Opex/Avg. AUM has declined from ~7.3% to ~6.2% over the same period. We expect a sustained improvement in the operating cost ratios with opex-to-avg. AUM declining to ~6.1%/5.8% in FY26/FY27.

Forward flows of overleveraged customers but asset quality resilient

* FIVESTAR has reported a gradual deterioration in asset quality over the last three quarters, with its 30+dpd rising to ~9.2% (up ~130bp in FY25-YTD). A larger part of this deterioration is because of delinquencies from overleveraged customers, macro weakness, and relatively weaker collections in Karnataka.

* However, to its credit, the company has consistently kept GNPA well below ~2%, showcasing the resilience of its portfolio even during a tough external environment and macroeconomic weaknesses. This has also resulted in credit costs remaining benign for the company, ranging between ~50bp and 80bp.

* The company implements focused collection efforts, with loan-sourcing officers also responsible for recoveries, supported by necessary legal toolkits to uphold resilient asset quality. The company does not expect MFIN guardrails 2.0, if implemented from Apr’25, to have any significant impact on its collections.

* We expect GS3 to normalize from the current level of ~1.6% (as of Dec’24) and stabilize around ~1.8%-1.9% in FY26 and FY27. We estimate credit costs of ~0.8% over FY26/FY27.

Valuation and View

* FIVESTAR currently trades at 2.3x FY27E P/BV. The stock has undergone a decent correction following the company’s downward revision in its AUM growth guidance, coupled with customer overleveraging, which raised concerns about any potential deterioration in asset quality. However, the company has consistently maintained strong asset quality even in a challenging external environment. We believe that valuations will re-rate when the company emerges out of the current macro weakness without any significant impact on its asset quality and again embarks on a stronger AUM growth trajectory.

* We believe that FIVESTAR is sweetly positioned to leverage the strong target opportunity in the small business loans (SBL with a ticket size of

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412