Buy Samvardhana Motherson International Ltd for the Target Rs. 129 by Motilal Oswal Financial Services Ltd

Margins remain resilient despite adverse macro

Margins likely to improve in 2H

* Samvardhana Motherson’s (SAMIL) 2QFY26 adjusted PAT at INR8.6b was well above our estimate of INR6.3b, growing 15% YoY. Its margin has remained stable YoY at 8.7% despite the adverse global macro headwinds, which is commendable.

* Given the better-than-expected performance in 2Q despite adverse global macro, we raise our earnings estimates by 9%/4% for FY26/FY27. We expect SAMIL to continue to outperform global automobile sales, fueled by rising premiumization and EV transition, a robust order backlog in autos and nonautos, and successful integration of recent acquisitions. Given the long-term growth opportunities, we reiterate our BUY rating on the stock with a revised TP of INR129, based on 24x Sep’27E EPS.

Margins remain stable YoY despite adverse macro

* Consolidated revenue grew 8.5% YoY to INR 301.7b (in line with our estimate of INR 298.3b). Adjusted PAT of INR8.6b in 2Q beat our estimate of INR6.3b. Adj. PAT grew ~15% YoY, aided by improved business performance and a reduction in finance costs.

* EBITDA margin was largely stable YoY at 8.7%, which was above our estimate of 7.8%. Margins have remained stable despite the adverse global macro headwinds, which is commendable. Transformative measures are ongoing in Western and Central Europe, with improvements already visible and expected to accelerate in 2HFY26.

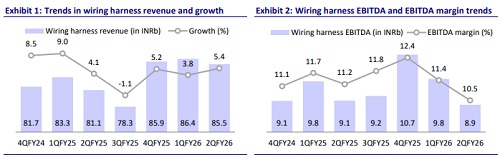

* On a segmental basis, the two segments that dragged overall performance were wiring harness (margin down 70bp YoY to 10.5% and below our est. of 11.3%) and emerging business (margin down 380bp to 8.7% and below our estimate of 9%). The wiring harness business was hit by cyclicality in the American CV market, while the emerging business faced business mix issues.

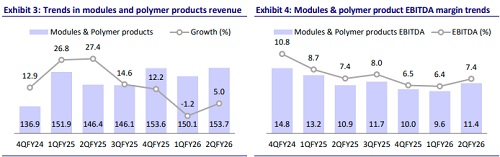

* Most of the other segments’ performance was largely in line: Modules and Polymers margins remained stable YoY at 7.4%, Vision Systems remained flat at 9.2%, and Integrated Assemblies gained 30bp to 12.2%.

* Net debt has increased to INR116b from INR112b QoQ due to higher working capital on tariff-led uncertainties.

* Total capex spend as of 1H stood at INR26.5b, with full-year guidance at INR60b. Cash flow from operations stood at INR34.2b, and hence, SAMIL was net cash positive, generating a cash balance of INR7.7b in 1HFY26.

Key highlights from the management commentary

* SAMIL continued to outperform industry growth with its 2Q revenues up 8.5% relative to global LV market growth of ~3%

* Management expects net debt / EBITDA to reduce to 0.9x by FY26 end

* Capex guidance is maintained at INR60b for FY26 with current quarter capex standing at INR14.5b (INR26.5b for 1HFY26)

* Order book worth USD87.2b has been generated with USD3b in non-auto related orders. EV share in automotive booked business has dipped from 24% at the end of FY25 to 22% in this quarter.

* SAMIL has incurred ~USD10m in tariff-related costs. Given that most of their facilities are close to customers, their impact has been minimal, considering the global scale of their business.

* Management noted that the Nexperia chip crisis will have minimal impact on their business as customers are actively working around it, and the company remains optimistic about the resolution soon.

Valuation and view

Given the better-than-expected performance in 2Q despite adverse global macro, we raise our earnings estimates by 9%/4% for FY26/FY27. Management has alluded to its next five-year revenue growth aspiration, which now stands at a staggering USD108b. We expect SAMIL to continue to outperform global automobile sales, fueled by rising premiumization and EV transition, a robust order backlog in autos and non-autos, and successful integration of recent acquisitions. While the ongoing tariff issue may lead to some near-term slowdown in some of its key geographies, we expect SAMIL to be the least impacted by these tariffs as it has all its facilities close to its customers and can effectively realign supplies as per customer needs. Further, this is likely to lead to industry consolidation, with players like SAMIL likely to emerge as key beneficiaries in the long run. Given the long-term growth opportunities, we reiterate our BUY rating with a revised TP of INR129, based on 24x Sept-27E EPS.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)