Buy State Bank of India Ltd for the Target Rs. 925 by Motilal Oswal Financial Services Ltd

Gaining size with granularity

Tech becoming key growth enabler; RoA to sustain at ~1%

? State Bank of India (SBIN)’s FY25 annual report highlightsthat the bank has steadily strengthened its balance sheet and consistently delivered healthy RoE while maintaining its leadership position. ? The Retail segment reported a 49% growth in PBT whereas treasury reported a 9% increase to INR176b. SBIN has delivered an earnings CAGR of 37% over past four years and crossed a key milestone of INR700b of profits in FY25. ? SBIN’s loan book grew 12% YoY in FY25, with modest growth in Xpress credit which has affected bank’s NIMs slightly besides the rise in funding costs. Consequently, the NIM dipped 30bp during FY25 to 3.0% (3.15% in domestic business). ? On the digital front, YONO continued to set new records with ~88m registered users and 64% of savings accounts opened through YONO in FY25. More than 0.33m overseas customers have been onboarded through YONO. This growth is supported by innovations in digital banking, including enhanced services like YONO 2.0 and expanding global reach. ? SBIN has maintained strong asset quality, with PCR at 74.4% (92.1% including TWO) in FY25. Controlled restructuring (0.3%), low SMA pool (8bp) with prudent underwriting and continued recoveries would keep credit costs under control. ? We estimate a 6% earnings CAGR over FY25-27, with an RoA/RoE of ~1.0%/15.9% in FY27. We maintain SBIN as our top BUY idea amongst PSU Banks with a TP of INR925 (premised on 1.2x FY27E ABV+ INR245 for subsidiaries).

~INR70t of “granular” balance sheet; retail mix rises to ~36%

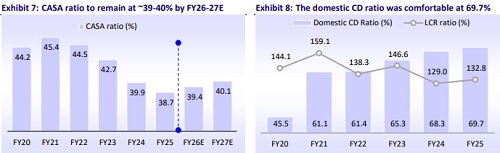

SBIN delivered a 12.4% YoY loan growth in FY25, backed by prudent underwriting while focusing on the granular, high-quality portfolio. Retail loans grew modestly at 11.4% YoY, making up 35.7% of the loan book. Xpress credit growth is showing signs of recovery as the bank has completely revamped the process of extending Xpress credit. Corporate loans grew ~9% YoY, despite some unexpected prepayments in 4QFY25, while the SME segment posted strong growth of ~17% alongside a notable reduction in GNPA from 9.2% in 1QFY22 to 3.3% in FY25. With a credit pipeline of INR 3.4t and a controlled domestic CD ratio of 69.7%, SBIN expects 12-13% credit growth in FY26. We estimate SBIN to report ~12% CAGR in loan books over FY25-27.

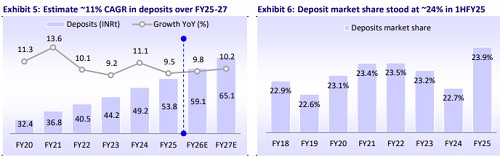

Deposit market share robust at ~24%; LCR ratio steady at 133%

SBIN’s deposits grew 9.5% YoY in FY25, maintaining a dominant 24% market share while the bank remains focused on increasing CASA deposits. With a favorable domestic CD ratio of 69.7%, well below peers, and a comfortable LCR of 133%, the bank is well-positioned for sustainable credit growth supported by robust underwriting and a potential corporate capex recovery. The incremental cost of deposits is also expected to come down as MCLR readjustment will also happen. We, thus, expect ~10% CAGR in deposits over FY25-27, while the bank maintains its focus on garnering granular retail deposits.

SR provisioning write-back and Treasury gains drive revenue growth.

SBIN is well positioned to benefit from the moderation in bond yields on its treasury portfolio as the rate environment has eased considerably. The 10-year G-Sec has moderated to 6.23% in the past 12 months. SBIN booked healthy treasury gains in FY25, especially in 4QFY25, as there were provisioning write-backs of INR38.75b on SRs issued by NARCL. Moreover, excess provisions of INR5.2b on the sale of NPAs to the securitization company have been credited in P&L. Treasury performance was healthy, as treasury PBT increased to INR176b in FY25 from INR95b in FY23, contributing ~17% to the total profits in FY25. Going forward, as the rate cycle eases, yields will moderate, which will provide an opportunity both on the MTM side and on the trading profit of the bank

NIM to remain broadly stable; NII to clock a 10% CAGR over FY25-27

SBIN experienced NIM pressure in FY25 due to rising funding costs and a slight deterioration in asset mix as Xpress loan book growth stood at 0.5% YoY. Consequently, the NIM contracted 30bp during FY25 to 3.0% (3.15% in domestic business). With the rate cut cycle starting and the rising possibility of more cuts in repo rate, banks may see further NIM pressure during the coming quarters. However, the increase in the MCLR rate (35bp increase over past one year) and a significant portion (35%) of the portfolio being MCLR linked will alleviate NIM pressures. We expect SBIN’s NIM to sustain at 2.9% over FY27E. SBIN’s CD ratio remains under control, positioning the bank to deliver healthy loan growth, thus supporting NII. We estimate a ~10% CAGR in NII over FY25-27.

Building strong digital capability; YONO emerging as a key growth driver

SBIN has established leaderships across Debit Card spends, POS terminals, ATMs, and mobile banking transactions (both in volume and value terms). YONO application continued to set new records, with ~88m registered users and 64% of savings accounts opened through YONO in FY25. More than 0.33m overseas customers have been onboarded through YONO. With the increasing scale of YONO adoption, it became imperative to build the next version of the YONO platform, i.e. ‘Only YONO - The New Digital Bank’ (YONO 2.0), which will be omni-channel in nature, hosted on the new tech stack to ensure high availability, scalability, and robustness.

Digitalization to help contain costs and improve productivity levels

SBIN is focused on enhancing operating efficiency through digital innovation and cost management. With wage/pension provisioning already being undertaken in prior years, we estimate the opex run-rate to post a 9% CAGR over FY25-27, though we will monitor the impact of falling interest rates on pension liability. We estimate the C/I ratio to reduce from 59% in FY24 to around 51.6% by FY27 driven by branch rationalization, increased digital adoption (notably via YONO), and productivity improvements.

Overhead spikes due to new PLI provision

? The increase in overheads in the last quarter of FY25 is primarily attributable to the provisioning for a new performance-linked incentive (PLI) scheme applicable to senior staff (Chief Manager grade and above), introduced this year and contingent on government approval. ? Traditionally there are two PLIs – one industry-wide 15-day pay and the other a 1% profit-linked grid-based incentive – both of which are accounted for under staff expenses. However, this new scheme has been booked under overheads given its distinct nature and approval requirement. ? Although the expense could have been recognized earlier, management has prudently provided for it in 4QFY25 based on their assessment that the bank qualifies under the Government of India's guidelines.

Credit costs remain under control; SMA book stands at 8bp

SBIN has maintained strong asset quality supported by robust underwriting and healthy recoveries from its TWO pool, with GNPA and NNPA ratios improving 42bp and 10p during FY25 to 1.82% and 0.47%, respectively. The bank maintains a healthy PCR of 74.4% (92.1% including TWO). During FY25, the bank reported benign slippages at INR208b (~0.5% of loans), while the restructured book stands under control at 0.3% of loans. ? With prudent underwriting and continued recoveries, we expect asset quality trends to remain stable, thus projecting the GNPA/NNPA ratio at 1.8%/0.4% by FY27, while credit costs remain in control at avg. 40bp over FY26-27E. ? RBI, recently has announced a policy reversal wherein it has restored the risk weights on exposures of banks to NBFCs and MFI to their orginal level, effective from 1st Apr,2025. This move is expected to improve SBI’s CET-1 ratio by 24 bps, as per our calculation. ? The regulatory change will reduce RWA requirements for these exposures, thereby strengthening the bank’s capital base. This enhanced capitalization provides headroom for supporting credit growth. Also, SBI sold 13.2% of its stake in Yes Bank to SMBC which will further strengthen bank’s capitalization.

Valuation and view: Reiterate BUY with a TP of INR925

SBIN has delivered a robust set of performances in recent years, propelled by steady business and revenue growth as well as controlled provisions. NIM has contracted in recent quarters, and the management has guided for broadly stable margins (negative bias depending on the quantum and timing of rate cuts). The bank has levers in place (CD ratio, MCLR re-pricing, asset mix improvement, etc.) to mitigate the impact arising from moderation in lending yields. SBIN’s asset quality remains healthy with consistent improvements in headline asset quality ratios, while the restructured book remains under control at 0.3% of loans. We estimate credit costs to remain in check at ~50bp, enabling a 6% earnings CAGR over FY25-27. We, thus, estimate SBIN to deliver RoA/RoE of ~1.0%/15.9% in FY27. SBIN remains our preferred BUY in the sector with a TP of INR925 (premised on 1.2x FY27E ABV+ INR245 for subsidiaries).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412