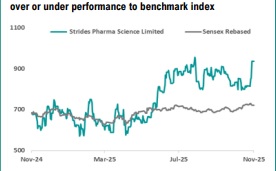

Accumulate Strides Pharma Science Ltd For Target Rs. 1,085 By Geojit Financial Services Ltd

Healthy Margin Expansion Fuels Strong Performance

Strides Pharma Science (STAR) is an R&D focussed, vertically integrated pharmaceutical company with an experienced management team a having presence across multiple therapeutic segments.

* Strides reported a 5% YoY revenue growth, driven by new product launches and an expanding market share in newer markets.

* Strides recorded a robust 25% YoY growth in EBITDA, driven by lower raw material costs, an improved product mix, and effective cost-optimization initiatives that helped reduce operating expenses.

* Adj. PAT rose sharply by 80% YoY, driven by a stronger gross margin mix, better operating leverage, and lower financing costs.

* The company remains committed to its target of achieving $400mn in revenue by FY28. A robust product portfolio, supported by over 60 pending low-competition launches, is expected to drive this growth in the U.S. market.

* Management remains optimistic about performance in other regulated markets, anticipating stronger revenue growth in FY26 as European partners prepare for product launches. The company also expects these markets to eventually generate revenue on par with its U.S. operations.

Outlook & Valuation

The company is poised to deliver a strong performance, supported by new product launches in diverse markets and continued cost optimization efforts. Its broad and differentiated portfolio provides near-term revenue visibility and supports further debt reduction, with capex expected to remain largely stable. Accordingly, we upgrade our rating to Accumulate, valuing the stock at 16x FY27E EPS with a revised target price of Rs.1,085.

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH200000345