Buy Eris Lifesciences Ltd for the Target Rs. 1,900 By Prabhudas Liladhar Capital Ltd

Muted revenue growth

Quick Pointers:

* Net debt stands at Rs23bn.

* Swiss Parenterals Unit-3 (general injectables), targeting commercialization in FY28E.

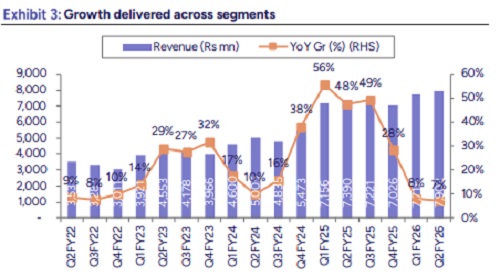

Eris Lifesciences’ (ERIS) Q2FY26 EBITDA was broadly in line with our estimate (Rs2.9bn; up 9% YoY). Though H1FY26 revenue growth (up 7% YoY) was muted, we see pick up in coming quarters as export pick up and likely additional market share gain from human insulin market. Eris has opted for inorganic route to diversify and scale up existing portfolio. This has been implemented without diluting margins. We expect margins to scale up from the current level of 35% in FY25 as revenue scales up from recent acquisitions, which are currently operating at sub-optimal profitability. The company has multiple growth levers such as broad-based offerings in the derma segment, tapping GLP-1 market, demand supply mismatch in insulin segment, creating large injectable franchise across India and RoW market and benefits of operating leverage. Our FY27 and FY28E EBITDA stands cut by ~2%. We maintain ‘BUY’ rating with TP of Rs1,900 (valuing at 18x EV/EBITDA on Sept 2027E).

* DBF growth at 10% YoY: ERIS reported revenue growth of 7% YoY to Rs7.9bn. Segment wise domestic formulations including Biocon business grew by 10% YoY while Swiss parenteral remained flat YoY. gSaxenda launch dropped owing to delayed approval timelines.

* In-line EBITDA, margins at 36.4%: EBITDA came in at Rs2.9bn (up 9% YoY) broadly in line with our est. OPM improved 57bps QoQ and 68bps YoY at 36.2%. Domestic business formulation margins expanded 32bps YoY at 37.6%. Biocon margins improved to 32% in Q2FY26 up from 19% at time of acquisition. Overall GMs declined both QoQ and YoY by 166bps and 41bps to 74%. Other expenses remained flat YoY. Resultant PAT came in at Rs 1.2bn (up 31% YoY) given lower interest charges. EPS stood at Rs 8.7/share.

* Key concall takeaways: Domestic branded formulation: Revenue growth was driven by 2% volume and 2.5% price. Deferred price increase in H1 (benefit to reflect in H2). RHI cartridge opportunity to start contributing from Dec’25. EBITDA margins expanded across segments. Biocon margin improved to 32% up 200bps QoQ, in-house manufacturing to lift margins further. Guidance: 12% growth for FY26, EBITDA growth 15% YoY (upside possible from RHI cartridge launch). Domestic EBITDA margin guided at +37%.

* Insulin: Market share increased from 10% to 15% in last 18months. Bhopal facility: recently upgraded with Rs 800mn capex; full utilization expected; next phase to double capacity (vials & cartridges) with further capex. Estimated additional Rs 500 mn annual EBITDA potential. Adding gAspart to existing partnership (recently approved interchangeable biosimilar). Biocon to leverage Eri’s plant for its RoW insulin expansion.

* GLP-1: RHI production line commissioned in Aug’25, cartridge line expected in Q1FY27E. Confident of supply sufficiency for FY26E despite delay in cartridge readiness. Strong traction in institutional segment (hospitals).

* R&D: Pipeline progressing well across insulin analogs and synthetic semaglutide. Bhopal facility fully validated, supporting Biocon and in-house insulin programs. Ongoing investments in diabetes pipeline and DS manufacturing to enhance backward integration. Swiss Parenterals Unit-3 (general injectables), targeting commercialization in FY28.

* Exports: Expect H2 to be heavier; visibility improving post ANVISA (Brazil) approval; next audit planned Jan’26. First European CDMO order received – exclusive manufacturing for Innovator brand across 6 EU countries, potential Rs 1.25–1.5bn in FY27E revenue, margins at business average. FY27E revenue mix expected: 30% from regulated markets, 50% private market share. International EBITDA margins ~33%.

* Capex in Q2: Rs 500Mn, H1 total Rs 1170mn. Upcoming spends ~3.8-4bn mainly towards Bhopal phase-2 insulin expansion Rs 1.5bn, Swiss Unit-3 injectables Rs 1.3bn and rest for GLP-1 & DS manufacturing.

* Others: Net debt: Rs 22.8bn. Targets <1.5x by Dec’26. OCF/EBITDA: 47% in Q2, impacted by higher GST receivables and statutory liabilities post distribution structure changes.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271