Buy Trent Ltd For the Target Rs. 7100 By the Axis Securites

Recommendation Rationale

Excellent growth despite challenging environment – Revenue growth of 37% YoY to Rs 4,535 Cr is commendable despite the challenging environment. The fashion format reported high single-digit LFL growth. For 9MFY25, revenue grew 43%, with a volume growth of 39%, driven by aggressive store expansion. The total footprint expanded by 33% over the last year, reaching 11 msq. ft across fashion brands.

Expanding footprint with strategic store openings: Trent added 12 Westside stores and 58 Zudio stores in Q3, taking the total store count to 238 and 635, respectively. Management reiterated its plan to undertake a store optimisation program, which involves upgrading or consolidating smaller footprint stores with newer micro-market stores. In the short term, there could be some slowdown in store openings; however, in the long run, larger and more aesthetically appealing stores will provide a sustainable competitive advantage to Trent.

Sector Outlook: Positive

Company Outlook & Guidance: We maintain our BUY recommendation as sharp correction provides a better entry point as the long-term outlook remains strong.

Current Valuation: SOTP

Current TP: Rs 7,100/share (Previous TP: Rs 7,450/share).

Recommendation: With a 35% upside potential from the CMP, we maintain our BUY rating on the stock..

Financial Performance The company’s revenue grew 7% YoY to Rs 4,535 Cr, while its fashion concept registered high single-digit LFL growth. EBITDA increased by 34% YoY, while EBITDA margins declined by 34bps YoY to 18.5%. PAT stood at Rs 469 Cr, up 37% YoY. Outlook: Although growth has decelerated, Trent’s revenue perfor

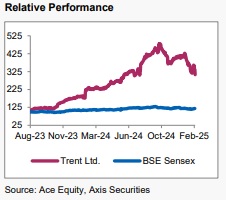

Outlook: Although growth has decelerated, Trent’s revenue performance remains impressive, given the challenging environment. Furthermore, the sharp decline in stock price (~35% from its recent high) following market concerns over increasing competitive intensity provides a better entry point for long-term investors. The long-term structural tailwinds in the retail sector and Trent’s low single-digit market share present a compelling opportunity for investors looking to capitalise on the retail growth story. We remain positive on Trent as we expect robust sales growth to continue ahead of its peers, underpinned by its strategic focus on rapid store expansion and continual assortment refreshment, which should drive higher footfall. Furthermore, earnings improvement across all formats reinforces our confidence. Trent’s recent approach to implementing its successful playbook at Star Business, driven by private labels, has proven beneficial and is expected to be a key growth catalyst. Additionally, the company's geographical expansion into the UAE, the launch of Zudio Beauty, and its entry into the fast-growing LGD Jewellery segment are anticipated to contribute significantly to long-term growth. Based on this thesis, we maintain a positive long-term outlook on Trent.

Valuation & Recommendation • We remain positive on the company and expect Revenue/EBITDA growth of 25%/28% CAGR on a standalone business over FY24-27E. We maintain our BUY rating on the stock and value the company on an SOTP basis with a revised TP of Rs 7,100/ share. Our TP implies an upside of 35% from the CMP.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633