Accumulate Navin Fluorine International Ltd For Target Rs.6,441 by Prabhudas Liladhar Capital Ltd

CDMO deep dive

Quick Pointers:

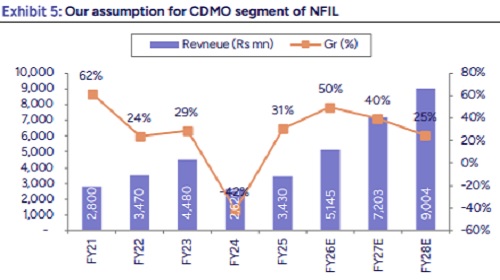

* CDMO achieved a sales of Rs2.3bn in H1FY26, +56.4% YoY

* Expect acceleration with commercial ramp up of end products

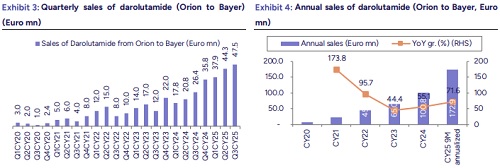

With its expertise in fluorine chemistry and deep relationship with pharma innovator companies developed over years, CDMO segment of Navin Fluorine (NFIL) is expected to deliver a strong 39% CAGR in FY25-28E. Our deep dive suggests that sales of darolutamide has risen by a CAGR of 56.6% in past 3 years (for Orion to Bayer) and is likely to reach peak sales of +USD3bn (to market). Additionally, the intermediate being supplied to GSK is likely for a product which is expected to be commercialized in 2027 and is also expected to be a blockbuster drug (annual sales >USD1bn). NFIL showed a strong upside post its Q2FY26 results and has given a return of 81.6% in past one year. It is currently trading at 39x FY28 EPS of Rs155.8 (consensus Rs156.4). With several potential triggers in place, the company’s EPS may witness further upgrades going forward, supporting additional upside in the stock. Accordingly, we raise our target price to Rs6,441 (from Rs5,601 earlier), valuing it at 46x Sep’27 EPS, and maintain our Accumulate recommendation.

* Darolutamide expected to see approval for more indications: NFIL has been supplying intermediate to Fermion for darolutamide. The drug patented by Orion Pharma and codeveloped by Bayer was first approved for nmCRPC (non-metastatic Castration Resistant Prostate Cancer) in the US in 2019 and in Japan and EU in 2020. The drug has also been approved for mHSPC (metastatic Hormone Sensitive Prostrate Cancer) in EU/China in 2023 and in the US in Jun-2025. It is also being studied for BCR (bio-chemical recurrence in prostrate cancer) in combination with ADT (Androgen Deprivation Therapy), with clinical trials started in 2023 and expected to be completed in 2025. Fermion is the manufacturer of darolutamide to which NFIL supplies the intermediate. Orion, which sells darolutamide to Bayer, registered a CAGR of 56.6% since CY22. Bayer had upgraded its earlier guidance of peak sales of darolutamide from USD1bn to +USD3bn.

* Another intermediate likely for another blockbuster product: The export data suggests that NFIL has been supplying a diethoxyacetyl intermediate to GSK for its drug undergoing clinical trials. Our study suggests that this might be an intermediate of camliplixant, which contains the same active group. GSK acquired this drug from Bellus Healthcare. This drug is meant for Refractory Chronic Cough (RCC) and is expected to be launched in a year or two. Just US sales is expected to be of +USD1bn. This could further boost CDMO segment of NFIL.

* Valuation and recommendation: We expect positive triggers in the stock- 1) possible extension of contract with Honeywell for HFO value chain, 2) commissioning of recently announced 15tmtpa R32-equivalent expansion, 3) CDMO growth led by near-to-market or commercial products and 4) further expansion of contract with Chemours post pilot. EPS CAGR during FY25-28E is 39%, the stock trades at 39x FY28 EPS of Rs155.8 (consensus Rs156.4). With several potential triggers on the horizon, we expect further upside in the stock. Accordingly, we raise our target price to Rs6,441 (from Rs5,601 earlier) and maintain our Accumulate recommendation.

* Navin could potentially witness an additional ~29% uplift in its EPS, under certain favourable scenarios: Should the planned 15tmtpa R32-equivalent incremental capacity ramp up ahead of expectations, it may create an additional revenue opportunity of ~Rs3bn over and above our base case. Additionally, a potential extension into Honeywell’s value chain could unlock a further Rs2-3bn, and with a possible Rs2.5bn incremental contribution from the CDMO segment, Navin’s revenue has an upside potential of nearly 18%. Assuming all other factors remain unchanged, this could translate into a 29% uplift in EPS, taking our FY28E estimate from Rs155.8 to Rs201.8 for FY28. At this EPS, the stock would be trading at 30x FY28E EPS.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271