Capital Markets : Round-up on rating agencies by Kotak Institutional Equities

Round-up on rating agencies

We upgrade CRISIL to REDUCE (from SELL) and ICRA to ADD (from REDUCE), following share price weakness in the past 12-15 months. While we remain constructive on the growth cycle for credit ratings, the non-ratings vertical lacks strong growth visibility (more so for ICRA). At an industry level, we are seeing nascent signs of more broad-based volumes, beyond just financial firms, along with a pickup in retail participation in the secondary markets, which augur well for the ratings cycle.

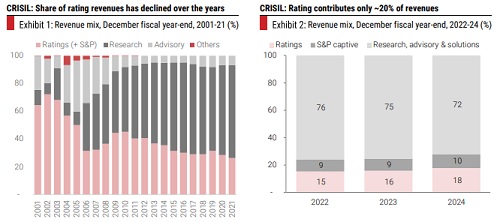

CRISIL: Valuations normalize but earnings capture upside; REDUCE (from SELL)

CRISIL shares have been effectively flat for two years, though multiple have had 30-35% up/down moves during the period. Current valuations, at close to the long-term mean, are much more reasonable. Our ~16% EPS CAGR over FY2025-27E builds in (1) 18% credit rating revenue CAGR, resulting in 18-19% ratings EBIT growth; (2) ~13% revenue CAGR in the S&P captive business with stable margins; and (3) 11% revenue CAGR in non-ratings, partly supported by M&A, driving 14% EBIT CAGR. We remain constructive on the ratings business, anticipating improved bond issuance activity and a potential pickup in corporate capex. Our view on the non-ratings business is a bit more subjective, given the lower disclosures compared to ratings. We upgrade the stock to REDUCE (from SELL), with an unchanged FV (Rs4,500), valuing it at ~30X March 2028E earnings. Growth visibility in the international business, while better than the previous year, remains uncertain (our estimates already factor in growth recovery) and optimism around domestic ratings is already reflected (through growth and multiples) in our SoTP-based FV of Rs4,600 (Rs4,500 earlier).

ICRA: Time correction opens upside; upgrade to ADD (from REDUCE)

ICRA shares have underperformed the broader markets, staying nearly flat for 12-15 months. For ICRA as well, we have a positive outlook on the domestic credit ratings business, with a ~15% revenue CAGR over FY2026-28E, supporting ~20% EBIT growth in the business. ICRA has been focused on diversifying revenues away from ratings. We have some concerns on the non-ratings business: (1) Growth struggle in Moody’s captive business (~30% of total revenues; ~35% EBIT margin) due to automation efforts and the scale-down of work related to ESG ratings; (2) inorganic-heavy nature of diversification efforts, which increases strategy and execution risks; and (3) a mixed track record with respect to revenue diversification strategy. We upgrade the stock to ADD (from REDUCE), primarily due to lower valuations resulting in a moderate upside to our SoTP-based FV of Rs7,000 (Rs6,900 earlier). At our FV, ICRA is valued at ~30X March 2028E earnings.

Corporate bond issuances and trading: Current state of the market

We put together some exhibits covering the current state of the primary and secondary bond market. We are seeing some uptick in the number of issuances by non-financial firms, although their share in the amount of debt rated is yet to show a similar pickup. We are also seeing strong secondary market activity, driven by: (1) growth in electronic trading across retail and institutional participants through the RFQ platform; (2) growth of online bond trading platforms, supported by lowering of face value to Rs10,000 from Rs1 mn; and (3) other measures such as information repository, reduced listing fees, capping ISINs per issuer to prevent liquidity fragmentation, etc.

Above views are of the author and not of the website kindly read disclaimer

More News

Daily Derivatives Report 03 July 2025 by Axis Securities Ltd