Buy Endurance Technologies Ltd for the Target Rs. 3,215 by Motilal Oswal Financial Services Ltd

Healthy operational performance across segments

Close to securing an entry in 4W suspensions

* Endurance Technologies (ENDU) delivered an in-line operational performance in 2QFY26. PAT miss was largely driven by higher-thanexpected depreciation and a higher tax rate in 2Q.

* We estimate a CAGR of ~17%/19%/18% in consolidated revenue/EBITDA/PAT over FY25-28 on account of healthy new order wins and its focus on ramping up presence in 4Ws in a meaningful way going forward. If ABS were to be mandated in all 2Ws as per the draft notification issued by MORTH, it would open up a huge growth opportunity for players like ENDU. The stock trades at 40x/33x FY26E/FY27E consolidated EPS. We reiterate our BUY rating with a TP of INR3,215 (based on 36x Sep’27E consolidated EPS).

Margins in line; PAT miss due to higher depreciation and taxes

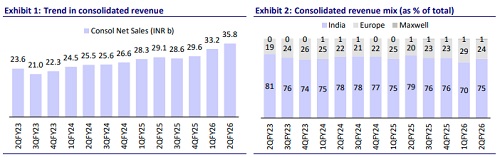

* 2QFY26 consolidated revenue grew 23% YoY to INR35.8b (in line with estimates), driven by ~17% YoY growth in the standalone (India) business (outperforming industry sales growth of 9.5%) and ~47.1% YoY growth in Europe (in INR; +33% in EUR terms), aided by the Stoferle acquisition and tooling sales. Organic growth in Europe is expected to be in line with the EU new car registration growth of 7.7% in 2Q. Maxwell revenue witnessed a 1.3x increase YoY (over a low base) to INR440m.

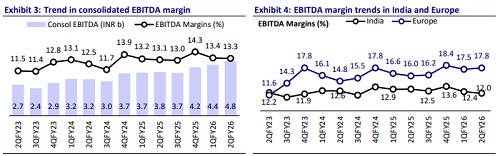

* Standalone performance: Standalone EBITDA margin contracted 100bp YoY to 12% (below our estimate of 13%), impacted by rising aluminum alloy prices. However, given the higher-than-expected revenue growth, EBITDA was in line with our estimate at INR3.2b.

* Europe performance: The European business witnessed strong growth from new hybrid/EV orders, a favorable mix, and the Stoferle consolidation. Europe EBITDA margin expanded 180bp YoY to 17.8%.

* Maxwell performance: Maxwell’s revenue surge was led by higher volumes from key OEMs, new BMS variants, and early traction in battery pack orders. Maxwell reported a positive EBITDA of INR19m in 2Q vs a loss of INR17m YoY.

* Consolidated PAT grew 12% YoY to INR2.3b (below estimates of INR2.5b). PAT came below expectations due to lower-than-expected other income, higher depreciation, and a higher tax rate in 2Q. PAT growth in 2Q was supported largely by inorganic growth (Europe PAT growth at 52.2% YoY). On the other hand, while standalone PAT grew 1.5% YoY to INR1.9b, Maxwell reported a reduced loss at INR9.5m vs a loss of INR44m in 2QFY25.

Highlights from the management commentary

* ENDU’s current ABS capacity will be ramped up to 640k units pa by 4QFY26. The company has now ordered another 1.2m units line, which can potentially be operational by 1QFY27. The balance 1.2m units line will be set up based on the timeline of the mandatory ABS regulation to be notified by the authorities.

* 1H order wins for ENDU stood at INR9.1b, which includes INR3b for the Talegaon battery-pack program and INR210m of BMS orders at Maxwell. It has close to INR42.1b worth of RFQs in discussion and expects another INR15b worth of new order wins in the coming 1-1.5 years. H1FY26 Europe order wins stood at EUR12.7m, taking the cumulative five-year order book to EUR242m.

* With support from a Korean technology partner for 4W suspensions, ENDU is close to securing an OEM entry.

* The company has started on-vehicle testing for its 4W driveshaft order with SOP expected in 4QFY26, and is establishing a dedicated assembly line to address increasing 3W and 4W demand. This business is expected to generate INR5b worth of business by FY28.

* It has so far invested INR4.6b in capex in 1H, and its FY26 guidance stands at INR8b for new projects. For Europe, the company has targeted capex of EUR30- 32m (having invested EUR in 1H) for FY26.

Valuation and view

* We estimate a CAGR of ~17%/19%/18% in consolidated revenue/EBITDA/PAT over FY25-28 on account of healthy new order wins and its focus on ramping up presence in 4Ws in a meaningful way going forward. If ABS were to be mandated in all 2Ws as per the draft notification issued by MORTH, it would open up a huge growth opportunity for players like ENDU. The stock trades at 40x/33x FY26E/FY27E consolidated EPS. We reiterate our BUY rating with a TP of INR3,215 (based on 36x Sep’27E consolidated EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412