Buy HPCL Ltd for the Target Rs. 590 by Motilal Oswal Financial Services Ltd

Strong refining, marketing momentum to continue

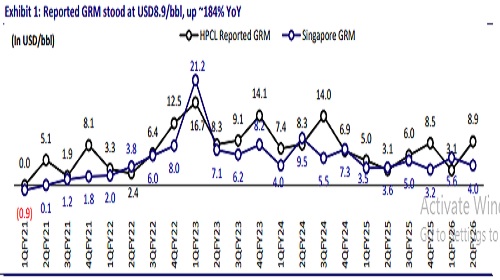

* HPCL’s 2QFY26 EBITDA came in at INR76.2b (29% beat), aided by a higher-thanestimated reported GRM of USD8.9/bbl (48% beat). GRM, adj. for inventory gains, stood at USD8/bbl. Marketing margin (including inv.) stood at ~INR5.8/lit (est. INR5.4/lit). The resultant PAT came in 29% above our estimate at INR38.3b.

* The MoP&NG, through letters dated 3rd and 24th Oct’25, approved a compensation of INR79.2b to HPCL for under-recoveries on the sale of domestic LPG up to 31st Mar’25 and those expected up to 31st Mar’26. The amount will be released in 12 equal monthly installments, with accruals recognized monthly starting Nov’25.

* We factor in LPG under-recovery compensation of INR6.6b per month over Nov’25-Oct’26 under revenue. Additionally, we raise our MS/HSD marketing margin assumptions for 2HFY26-FY28 slightly to INR3.5/lit (from INR3.3/lit earlier). These revisions collectively drive a 23/27% upward revision in our FY26/27 EBITDA estimates.

* In line with management’s indication of deferring the lubricant business spinoff and associated value unlocking, we exclude the earlier embedded value of ~INR37.5/sh from our TP. We now value HPCL’s standalone operations at 6.5x Dec’27E EV/EBITDA (vs 6.5x FY27E earlier), resulting in a revised SoTP-based target price of INR590/sh.

* We continue to prefer HPCL among OMCs due to the following factors: 1) HPCL’s higher leverage toward the marketing segment, 2) higher dividend yield as HPCL’s capex cycle is tapering off, and 3) start-up of HPCL’s multiple mega-projects in the next 12 months, providing a push to earnings.

* HPCL currently trades at 1.4x FY27E P/B. We estimate the company to deliver 29.3%/19.9% RoE during FY26/27 and estimate a 3.6% FY27E dividend yield. Our earnings assumptions remain conservative as we build in a refining GRM of USD6.5/bbl and an MS/HSD gross marketing margin of INR3.5/lit. We have not assumed any significant benefit from 1) the start-up bottom-upgradation unit and 2) Project Samriddhi, which has unlocked savings worth USD0.5/bbl in 1HFY26. We reiterate our BUY rating on the stock with our SoTP-based TP of INR590.

Key takeaways from the management commentary

* HRRL has achieved 89% overall physical progress, with the refinery section surpassing 95%. Crude feed into the CDU is anticipated within the current calendar year.

* HRRL shall be depreciated over a period of 40 years (~INR20b depreciation p.a.). Interest cost shall be ~INR40b p.a. (before refinancing).

* At the Residue Upgradation Facility (RUF) in Visakhapatnam, precommissioning activities were completed on 30 Oct’25.

* The Mumbai refinery, which was temporarily shut down due to contaminated fuel, is now fully operational and ramping up to its full capacity.

* In 2Q, the Russian crude proportion stood at 5% only.

* Capex for 2QFY26 was INR32.6b, bringing the total for 1HFY26 to INR61.2b.

* India’s largest LPG storage cavern, with a capacity of 80 TMT, was commissioned in Mangalore during the quarter.

Beat fueled by higher-than-estimated GRM

* HPCL’s EBITDA stood at INR76.2b (29% beat), aided by a higher-than-estimated reported GRM of USD8.9/bbl (48% beat).

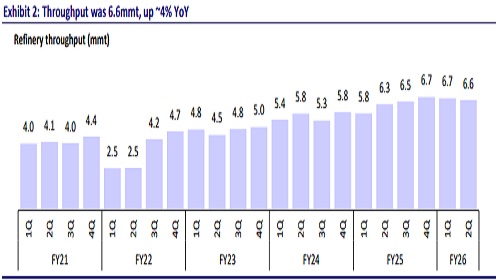

* Marketing margin (including inv.) stood at ~INR5.8/lit (est. INR5.4/lit). Refining throughput was in line at 6.6mmt. Marketing volumes also came in line at 12.1mmt.

* LPG under-recovery stood at INR12.4b (down 42% QoQ).

* PAT came in 29% above our estimate at INR38.3b. Other income, depreciation, and finance costs were below our estimates.

* However, forex loss stood at INR7.3b. As of Sep’25, HPCL had a cumulative negative net buffer of INR142.4b due to the under-recovery on LPG cylinders (INR130b as of Jun’24).

* As of Sep’25, net debt stood at INR549.2b (vs. INR631.6b as of 31st Mar’25).

* The Board has declared an interim dividend of INR5/sh (FV: INR10/sh).

Valuation and view

* HPCL remains our preferred pick among the three OMCs. We model a marketing margin of INR3.5/lit for both MS and HSD in 2HFY26/FY27/FY28, while the current MS and HSD marketing margins are significantly above these levels. We view the following as key catalysts for the stock: 1) the commissioning of its bottom-upgrade unit by the end of 3QFY26, and 2) the start of its Rajasthan refinery by Dec’25.

* HPCL currently trades at 1.4x FY27E P/B, which we believe offers a reasonable margin of safety as we estimate FY27E RoE of 19.9%. We value the stock at our SoTP-based TP of INR590. Reiterate BUY.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)