Neutral BPCL Ltd for the Target Rs. 395 by Motilal Oswal Financial Services Ltd

Strong 2Q; capex cycle clarity key to re-rating

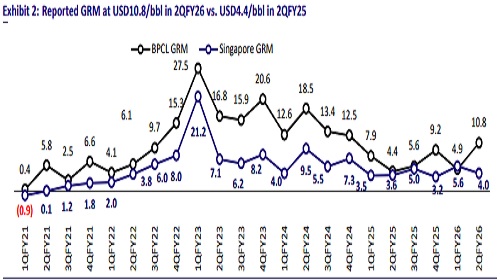

* BPCL’s EBITDA/PAT came in 32%/40% above expectationsin 2QFY26, driven by higher-than-anticipated GRM (USD10.8/bbl). Blended marketing margin also stood 35% above our estimate at INR7.2/lit (up 25% YoY). Refining throughput and marketing volumes came in line with estimates.

* While we reiterate our Neutral rating on BPCL, we are incrementally more positive on the stock, given: 1) the continued robust marketing and refining environment supported by healthy demand, a favorable regulatory stance, and weak propane prices, 2) recent announcements (signing of non-binding MoU exploring investment collaboration on the Andhra refinery + potential tax sops) have alleviated concerns, to some extent, around the sharp rise in net debt and enhanced the economic attractiveness of the Andhra refinery project, 3) recent announcement by Total, BPCL’s partner in Mozambique LNG project (INR15/share in TP), regarding the lifting of force majeure, which is a positive development and could reopen a new avenue for growth.

* The MoP&NG, through letters dated 3/24 Oct’25, approved a compensation of INR75.9b to the company for under-recoveries on the sale of domestic LPG up to 31 Mar’25, as well asthose expected up to 31 Mar’26. The amount will be released in 12 equal monthly instalments, with accruals recognized on a monthly basis starting Nov’25.

* We factor in LPG under-recovery compensation of INR6.3b per month over Nov’25-Oct’26 under revenue. Additionally, we raise our MS/HSD marketing margin assumptions for 2HFY26-FY28 slightly to INR3.5/lit (from INR3.3/lit earlier). These revisions collectively drive a 20% upward revision in our FY26/27 EBITDA estimates.

* BPCL currently trades at 1.4x one-year forward P/B vs the 10-year average of 1.8x. We have a Neutral rating on BPCL.

Strong refining; marketing inventory gains boost profits

* BPCL's reported GRM came in above our estimate at ~USD10.8/bbl (our estimate USD9.0/bbl), with marketing margin (including inv.) coming in 35% above our estimate at INR7.2/lit.

* Consequently, standalone EBITDA was 32% above our estimate at INR97.8b, with marketing inventory gain amounting to INR9b and forex loss of INR5.6b.

* LPG under-recovery amounted to INR11.5b (INR20.8b in 1Q).

* Resulting standalone reported PAT stood 40% above our estimate at INR64.4b.

* Other income came in 12% above our estimates

* Operational details:

* Refining throughput stood below our estimate at 9.82mmt (-4% YoY).

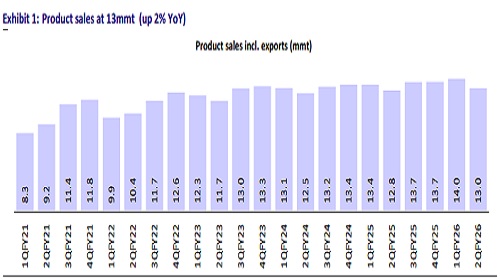

* Marketing volumes, excluding exports, were in line with our estimate at 12.7mmt (+2% YoY).

* As of Sep’25, BPCL had a cumulative negative net buffer of INR136.7b due to the under-recovery on LPG cylinders (INR125.2b as of Jun’25).

* Its debt has declined to INR112.6b, which is 47% below the debt as of 31st Mar’25.

Valuation and view

* BPCL’s GRMs have been at a premium to SG GRMs due to the continuous optimization of refinery production, product distribution, and crude procurement. The use of advanced processing capabilities of Bina and Kochi refineries allows BPCL to process 100% of high-sulfur crude and 50% of Russian crude.

* We maintain our GRM assumptions. Current marketing margins remain healthy, above the INR3.5/lit we are building in for MS/HSD.

* While valuation appears reasonable and strong marketing performance continues, a muted medium-term refining outlook (our FY27/FY28 PAT estimates are 9%/11% sensitive to every USD1/bbl change in GRM) and the commencement of a new capex cycle emerge as key concerns. Hence, we reiterate our Neutral rating with an SoTP-based valuation of INR340/share.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412