Buy Global Health Ltd for the Target Rs. 1,480 by Motilal Oswal Financial Services Ltd

Healthy growth in patient volume and realization

Noida/Ranchi opex keeps EBITDA growth in check

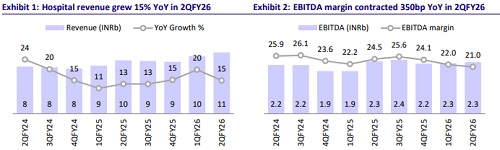

* Global Health (Medanta) delivered better-than-expected revenue (9% beat) in 2QFY26. However, it delivered marginally lower-than-expected EBITDA/PAT (3%/2% miss) for the quarter.

* In-patient (IP) and out-patient (OP) volumes saw healthy mid-teen YoY growth for the fourth consecutive quarter.

* Realization per patient (ARPOB) increased due to the rising share of Oncology in case mix and better realization in other therapies.

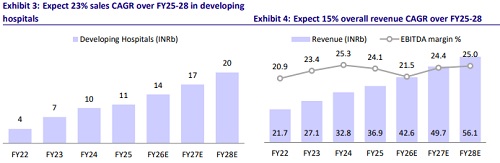

* The developing hospital segment reported robust YoY growth for the third consecutive quarter, largely supported by the increase in patient volume. The recent commissioning of the Noida hospital should boost patient volume going forward.

* We trim our earnings estimates by 6%/2%/3% for FY26/FY27/FY28, factoring in additional costs from operations at Noida/Ranchi hospitals and a moderation in the profitability of matured hospitals. We value Medanta at 30x 12M forward EV/EBITDA to arrive at a TP of INR1,480.

* We expect a CAGR of 15%/16%/23% in revenue/EBITDA/PAT on the back of improved traction in developing hospitals (Lucknow/Patna) and scale-up in Noida hospitals. Medanta’s established franchise would help it to sustain the performance of matured hospitals. Medanta is also expanding the number of beds at the existing locations and new locations (Mumbai/ SouthDelhi/Pithampura/Guwahati), taking the total bed capacity from 3,435 to 4,082 by FY27 and 6,382 once all the current projects are commercialized. Maintain BUY.

Revenue growth remains firm on the back of IPD/OPD volume uptick

* In 2QFY26, sales grew 15% YoY to INR11b (vs our est: INR10.1b).

* EBITDA margin was largely stable at 21% YoY (our est: 23.5%).

* EBITDA declined 1.5% YoY to INR2.3b (in line).

* Medanta had a one-time gain of INR160m on account of reversed stamp duty payable to the government of Delhi NCR due to the merger of Medanta Holding Private Limited and the Holding Company.

* Adjusting for one-off gain, PAT grew 11.4% YoY to INR1.5b. (in line)

* Mature hospitals’ revenue (67% of total revenue) grew 5.4% YoY to INR7.2b, EBITDA stood at INR1.7b, and margins contracted 120bp YoY to 23.5%.

* Developing hospitals’ revenue (33% of total revenue) grew 29.7% YoY to INR3.6b, EBITDA stood at INR915m and margins contracted 450bp YoY to 25.6%.

Highlights from the management commentary

* Medanta launched its Noida hospital in Sep’25 and has onboarded 150+ doctors till now at this site. Revenue/opex stood at INR39m/INR197m in 2QFY26.

* At the Noida hospital, insurance empanelment will be completed soon.

* Additional FSI approval is received for its Mumbai hospital, increasing the scope of bed capacity expansion from 500 to 750 beds now. The project cost is revised to INR15.3b accordingly.

* Medanta has onboarded 49+ doctors at sites, excluding Noida. It witnessed minimal attrition of doctors at its hospitals.

* International patient volume remains strong for Medanta.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)