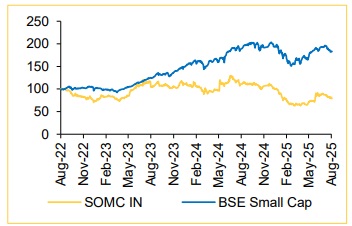

Add Somany Ceramics Ltd for the Target Rs.635 by Choice Broking Ltd

Management’s Core Plus Satellite Approach is the Right Way Forward

We maintain BUY rating on Somany Ceramics (SOMC) with a revised target price of INR 635/share (from INR 540 earlier). We factor in: 1) volume CAGR of 9% over FY25-28E driven by market share gains from unorganized players in the Tiles segment, 2) Bathware segment revenue CAGR of 12% over FY25-28E, 3) higher revenue contribution of 28% from projects segment (vs. 23% in Q1FY26) which is a higher margin business. The strong launches and sales of Real Estate sector between FY22 to FY25 would help drive volume for SOMC during FY26- 28E as these projects near completion, 4) EBITDA margin expansion of ~347bps over FY25-28E.

We forecast SOMC EBITDA/EPS CAGR of 23/48% over FY25-28E, basis volume CAGR of 9%, and realization CAGR of 0.4% over the same period.

We arrive at a 1-year forward TP of INR 635/share for SOMC. We now value SOMC on our PEG ratio based framework – we assign a PEG ratio of 0.9x on FY25-28E core EPS CAGR of 48%, which we believe is a conservative multiple. This valuation framework gives us the flexibility to assign a commensurate valuation multiple based on quantifiable earnings growth.

We do a sanity check of our PEG ratio based TP using implied EV/EBITDA, P/BV, and P/E multiples. On our TP of INR 635, FY27E implied EVEBITDA/PB/PE multiples are 7.8x/2.6x/17.4x all of which are reasonable in our view. Increased dumping from Morbi into the domestic market, slowdown in Real Estate execution and home improvement activities are risks to our BUY rating.

Separately, SOMC’s Kassar plant, with a 23.32 MSM capacity (29% of total), has halted operations starting Aug 17th due to gas supply disruption. However, there is sufficient stock to ensure no sales impact according to SOMC's filing. All other plants remain operational.

Q1FY26: Marginally Better Than Larger Peer

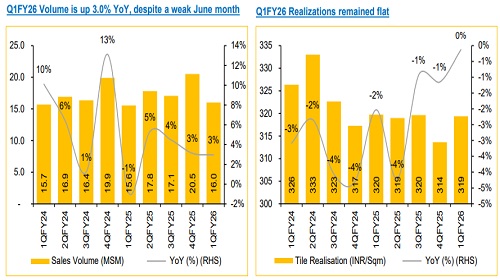

Tiles: Q1FY26 volume came in at 16.0 MSM (up by 3.0%/(22.0)% on YoY/QoQ), realization remained flat on YoY/QoQ to INR 319 per SQM, while revenue was up by 2.8/(20.6)% YoY/QoQ to INR 5,113Mn, (vs CIE est of INR 5,169Mn).

Bathware: Q1FY26 Bathware segment revenue grew by 4.0/(33.1)% YoY/QoQ to INR 629Mn, (vs CIE est of INR 696Mn)

SOMC reported Q1FY26 consolidated Revenue/EBITDA of INR 6,044Mn (+4.5% YoY, (21.4)% QoQ) / INR 482Mn ((1.6)% YoY, (16.8)% QoQ) vs CIE estimates of INR 6,195Mn and INR 511Mn, respectively. Core PAT for Q1FY26 came in at INR 104Mn, (vs CIE est of INR 135Mn), down 16.6/51.4 on YoY/QoQ, EPS for the quarter came in at INR 2.5 vs CIE estimates of 3.9.

Tiles segment - guidance for FY26 is conservative in our view:

Management is targeting high single-digit volume growth and a 100–150 bps EBITDA margin improvement in FY26, supported by a strategic shift towards higher-margin project sales. Project sales are expected to increase to 28% of the revenue mix in FY26, up from 23% in Q1FY26, with a corresponding decline in channel sales. This shift is driven by Real Estate sector projects entering into finishing stage over FY26E-28E from the strong launches and bookings witnessed between FY22-25, encouraging SOMC to adopt a more aggressive approach in the project segment, which generally has higher margins compared to select channel sales.

Bathware segment – guidance for FY26 is optimistic, but achievable in our view:

Management is now targeting lower double digit growth for FY26 (on a low base though) backed by Real Estate demand and a differentiated product portfolio, which is achievable in our view.

JV with Dura Build Care Private Limited: SOMC has completed the acquisition of a 51% equity stake in Dura Build Care Private Limited (DBCPL), purchasing 11,04,886 shares for INR 103Mn, making DBCPL its subsidiary. DBCPL, is an Indian manufacturer, specializes in construction chemicals and building materials like waterproofing compounds and repair systems, with manufacturing units in Haryana and Karnataka. The JV marks the SOMC’s entry into a high-margin construction chemicals business, with a total addressable market of INR 110-120Bn across waterproofing and admixtures. DBCPL brings 150 IPs, with a roadmap for full acquisition over 3–4 years.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131