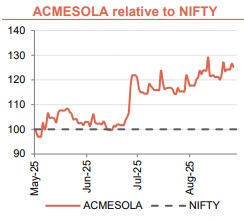

Buy ACME Solar Holdings Ltd for the Target Rs. 380 By Dolat Capital

A High-Voltage Bet on India’s Green Energy Transition

We initiate coverage on ACMESOLA with a ‘BUY’ rating and DCFbased TP of Rs. 380 implying 10x of FY28E EBITDA. ACMESOLA is among India’s top leading Renewable Energy (RE) Independent Power Producers (IPPs), with 2.9GW of operational capacity and a strong commissioning pipeline that is expected to scale capacity to ~7GW by FY29E. The company has set a long-term goal of reaching 10GW contracted capacity by 2030, implying a 3.4x growth, and is also uniquely positioned to gain from 1) GST reforms – structurally positive; 2) QIP to aid projects equity funding; 3) RPO supporting the overall portfolio, and 4) Diversification into BESS return ratio accretive; We expect a Revenue/EBITDA/ PAT CAGR of 66%/68%/78% over FY25-28E. Initiate ‘BUY’ rating.

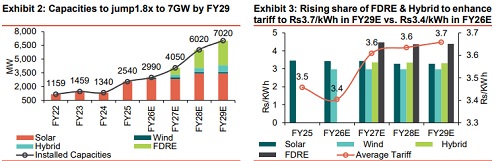

Strategic shift to FDRE/Hybrid unlocks High CUF & Premium Tariffs

ACMESOLA to commission an incremental 4.1GW of contracted capacity by FY29E, of which FDRE (64%) and Hybrid (18%) will form the bulk. Post commissioning entire capacity of 7.2GW, the share of solar, FDRE, hybrid, and wind capacities is estimated to be 49%, 38%, 11%, and 2% resp. This marks strategic transition to complex and integrated RE, such as Hybrid and (FDRE), which offer superior CUF compared to solar. FDRE projects achieve CUF of ~50%, significantly surpassing the ~28% CUF of solar. Similarly, Hybrid projects demonstrate a CUF of 36%, while the overall portfolio's average CUF has increased from 27.6% in FY25 to 37% in FY8E due to a strategic shift to FDRE/Hybrid. The average tariff realized by FDRE projects is ~Rs4.5/kWh, reflecting the premium compared to the ~Rs3.0/kWh for solar. In addition, Hybrid and wind projects have average tariffs of Rs 3.5/kWh and Rs 3.0/kWh, respectively, driving stronger annual revenue generation at 66% CAGR over FY25-28E.

Softening prices of Solar Module and Battery to boost returns

3 main components of the FDRE: Solar (48% of project cost), Wind (20%), and BESS (31%). Over the past 2 years, Solar Module prices decreased by ~40%, while grid battery prices declined by ~65%, and ACME secured 2.6GW of FDRE projects. Typically, it takes 2 years from signing the PPA to complete an FDRE project and the majority of power-producing equipment is installed during the final 6-9 months. To date, ACME has LoA with REIA of a total 2.7GW in FDRE projects, requiring ~10.1GWh of Battery capacity. A $10/kWh fall in battery cost will result in a 3.5% reduction in capital cost and contribute to improved return ratios. Similarly, a 10% fall in Solar Module price will lead to a 5% decline in capital for FDRE.

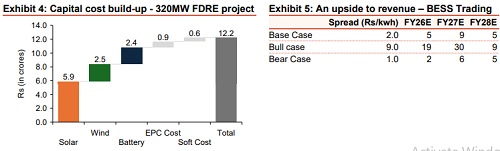

Early Battery rollout at FDRE to drive revenue growth

ACMESOLA plans to commission BESS ahead of FDRE CoD, enabling to capture merchant price arbitrage and unlock higher returns. ACMESOLA has already ordered 5.2GWh of battery storage, 2.5GWh to be installed by end-2025, followed by an additional 3-3.5 GWh in 1H-CY26 and the remaining 3-3.5 GWh in 2H-CY26.According to our BESS trading model, even with a conservative estimate of Rs2/kWh spread, ACMESOLA could boost overall revenues by 5%/9%/5% in FY26E/FY27E/FY28E, resp.

BESS project – Attractive Equity IRRs of ~18% (Ghani) and ~16% (Kuppam)

ACMESOLA has diversified into the BESS standalone project and won tender for 275MW/550MWh. As a part of the project, ACME Solar will get Rs2.7mn MWh or 30% of the total project cost, whichever is lesser. No investment required for evacuation infrastructure or substation development. Capex limited to US$100/kWh for system installation. Revenue generation from both projects (Ghani + Kuppam) would be Rs700mn/annum. BESS yields a 12% project IRR and a 16% equity IRR.

Valuation

We expect supernormal EBITDA CAGR of 68% and PAT CAGR of 78% over FY25- 28E, on the back of (1) incremental capacity commissioning of 3.5GW, the majority will be made up of FDRE/Hybrid, accounting for 64% and 18% resp, which will enhance overall CUF/tariffs to 37%/Rs3.7 per kWh; and (2) Early Battery Rollout at FDRE to Drive Revenue Growth - early installation opportunity at FDRE stands to boost overall revenue by 5%, 9%, and 5% for FY26E, FY27E, and FY28E respectively. The company is poised for growth with an expected rise in RoACE from 7% in FY25 to 9.5% in FY28, along with an improvement in RoE from 7% in FY25 to 22.4% in FY28E. Return ratio expansion would be backed by (1) Softening prices of Solar Module + Battery - A $10/kWh fall in battery cost will result in a 3.5% reduction in capital cost and contribute to improved return ratios. Similarly, a 10% fall in Solar Module price will lead to a 5% decline in capital for FDRE; and (2) Diversified to BESS standalone project - based on our calculations, BESS yields a 12% project IRR and a 16% equity IRR..

We have currently factored in Revenue CAGR of 45% over FY25-30E based on the existing portfolio of ~7.1GW commissioning by FY29E, along with Average EBITDA margins of 90% over FY26-FY30E with cost of Equity ~11% and terminal growth rate of 4%. Taking these assumptions, value the stock on DCF basis with TP of Rs380/share and WACC assumptions of ~7.5% (implies 10x of FY28E -EBITDA). We initiate coverage with a ‘BUY’ recommendation. The implied EV/EBITDA multiple for the target price would be 10x for FY28E.

Above views are of the author and not of the website kindly read disclaimer

.jpg)