Buy Max Financial Services Ltd For Target Rs.1,925 by Prabhudas Liladhar Capital Ltd

Growth to sustain; margin outlook favorable

We met with the management of Axis Max Life to identify key drivers of growth and margin outlook over the medium-term. Company expects tailwinds from strong protection growth in H2 and has launched new products across PAR/ NPAR and annuity to drive growth. It expects agency/ e-commerce channel and new banca partners to sustain growth momentum over the medium-term. While FY26E VNB Margin is likely to see a drag from GST exemption due to nonavailability of ITC, it expects re-balancing of product mix (towards NPAR/ protection) and cost optimization initiatives to absorb the hit. We build a positive margin profile - 24.2%/ 24.6% for FY26/ FY27E as the share of NPAR/ protection improves. We value Max Life using the Appraisal Value framework with a TP of Rs1,925 (2.1x FY27E P/EV vs. 2.0 earlier). Strong outlook on growth and margin trajectory to be key positives. Retain BUY.

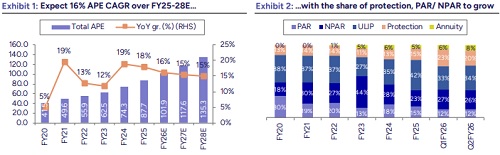

* Multiple levers to sustain growth momentum: 2QFY26 APE grew 15% YoY driven by protection and NPAR and company expects the momentum to continue to H2. It expects near-term tailwinds in retail protection volume post GST exemption and expects a recovery in credit life disbursals to drive growth. Newly launched products - Smart VIBE (NPAR), SWAG 2.0 (PAR) and SWAG Pension (Annuity) are seeing strong traction and are expected to offset the de-growth in ULIP (-9% YoY in Q2). Over the medium-term, company expects to maintain a diversified product mix with ~35% in ULIP, 15%/ 25% in PAR/ NPAR, 10-15% in protection and 5-7% in annuity. We build an APE growth of 16% CAGR over FY25-28E driven by robust growth in protection and new launches across PAR/ NPAR/ annuity.

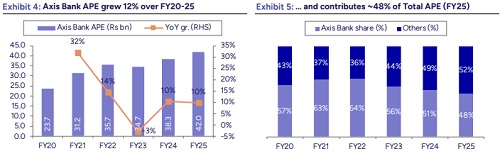

* Proprietary and new banca partners to drive growth: Proprietary channel (+22% YoY) contributed 46% of APE in Q2 and constitutes agency, direct and e-commerce. Company has recruited new 64k agents since FY22 and is now looking at productivity levers to drive higher growth from the channel. Within e-commerce, Axis Max Life has been ranked #1 in online protection and recently launched savings business and expects to maintain the position. Within banca, it has tied up with new partners- South Indian bank, Ujiivan SFB, Tamil Nadu Mercantile Bank, CSB and DCB and already has the highest counter-share in 3 out of the 6 new banks. Post re-branding, company has identified verticals within Axis Bank (Bharat banking, credit card segment, D2C) to get exclusive leads/ access to customers and has dedicated manpower (~7k employees) across Axis Bank branches. Company has 65-70% counter-share within Axis Bank and expects to maintain it at a similar level over the medium-term. While Axis Bank as a channel has grown 12% over FY20-25, it expects new banca partners/ proprietary channel to grow faster. Company has also started selling via brokers in FY23 and expects the channel to contribute to growth.

* VNB Margin to range between 24- 25%: The company highlighted a negative gross impact of ~300-350bps on FY26E VNB margin due to non-availability of Input Tax Credit. However, it is undertaking various measures such as distributor re-negotiations, cost optimization/ efficiency initiatives such as cut in discretionary expenses (consulting, professional, legal, travel) to offset the impact. Moreover, strong growth in protection/ NPAR in H2 is likely to absorb the hit from GST exemption. H1FY26 VNB Margin stood at 23.3% and the company reiterated a guidance of 24-25%, considering the drag from GST exemption. We build a margin of 24.2%/ 24.6% for FY26/ FY27E, driven by a favorable product mix.

* Awaiting reverse merger guidelines: Company expects the Insurance Bill to be passed in the Winter/ Budget session of Parliament, with a clear timeline for its reverse merger with Max Financial. On composite licenses, it is in discussion with health insurance companies to distribute retail health. It expects IFRS-17 to be applicable over the next 2 years and has submitted proforma statements to IRDAI for easier implementation.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271