Buy CAN FIN Homes Ltd For Target Rs. 870 By Yes Securities Ltd

An underwhelming quarter

Weak trends in disbursement and asset quality

Can Fin’s operational performance was meek in Q3 FY25, characterized by moderate disbursements and material increase in the delinquent pool. Earnings delivery and RoE was supported by expansion in portfolio spread on the back of reduction in funding cost and slight increase in portfolio yield. Disbursements were 21% lower sequentially at Rs18.8bn owing to significantly slowed registration in home market of Karnataka (28%/33% AUM/Disb share) following the introduction of E-khata and weakened market sentiments in Telangana (19%/15% AUM/Disb share). Portfolio Yield continued inching-up on sustained shift in portfolio mix towards SENP HL and LAP, upward repricing of preferentially priced loans completing one year and pricing adjustments for likely weakened customer profiles. Funding cost declined marginally on substitution of relatively higher costing MCLRlinked bank loans, enabled by availment of NHB funding of Rs16bn. SMA 0 bucket rose sharply by 31% qoq and GNPLs increased by 7% qoq, underpinning higher credit cost of annualized 24 bps.

Growth and asset quality commentary remains optimistic

With improvement seen in issuance of E-khata in Karnataka and other markets (NCR, TN, AP, MH, GJ & RJ) growing well, Management expects disbursements in Q4 FY25 to be around Rs24bn at the least. The co. targets business of Rs120bn in FY26, which would be supported by branch addition, augmentation of newly formed sales vertical, quick recovery in Karnataka volumes and stabilization of Telangana, and the opportunity for penetration in SE HL and LAP markets. Can Fin hopes to achieve the aspired disbursements notwithstanding the transient impact on operations from the planned upgradation of Tech platform (LOS & LMS). Company expects correction in SMA 0 bucket going ahead with >30% of the pool being accounts where just the cheque bounce charges remain unpaid. A Rs150-200mn GNPL reduction is expected in Q4 FY25 due to focused recovery efforts. Credit cost is expected to normalize hereafter.

Material cuts in earnings; actual revival in growth and improvement in delinquent pool awaited

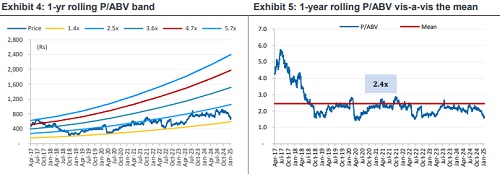

We have cut FY26/27 earnings estimates by 7-10% on moderating our growth assumptions and tweaking the opex and credit cost. Our loan growth estimate of 12- 13% p.a. for the next two years is meaningfully below management’s expectations, and we would eagerly await sustained recovery in disbursements volumes for raising our view. Even on the asset quality front, a durable reduction in the delinquent pool would offer comfort. Stock trades at 9.8x P/E and 1.4x P/BV on FY27 revised estimates and investor’s moderated growth and RoE expectations would keep valuation under check. While we retain BUY recommendation, the 12m PT has been cut to Rs870

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632