Reduce Fortis Healthcare Ltd For Target Rs.927 By Elara Capital

Strength Priced In

Fortis Healthcare (FORH IN) Q 3FY2 6 revenue and EBITDA were broadly in line with our estimates , but PAT came below by 4% as higher D&A and finance cost hurt . The h ospitals segment performance remain s strong with 19% YoY growth and 170bp YoY margin expansion . Additional revenue from operations & management (O&M) agreement with Gleneagles Hospital may have lifted margin. The diagnostics segment revenue growth remains unimpressive at 8.5% YoY , but EBITDA margin was strong at 23%, up 9 00bps YoY . Management retained FY26 target for both segments and indicat ed room for further growth and margin expansion in FY27; we have already built th is into our estimates . We keep our FY26 -FY2 8 EBITDA and core EPS estimates broadly unchanged . We downgrade our rating to Reduce, as we see limited upside after ~50% stock price performance in the past year. We keep our TP unchanged at I NR 927.

Growth and margin expansion continues in the hospitals segment: Revenue and EBITDA from the hospitals segment grew at ~ 19.4% YoY and 29.2% YoY , respectively , in Q3FY2 6. Average rate per operating bed (ARPOB) growth of 6% and addition of beds at Manesar and Jalandhar bolstered top -line growth. EBITDA growth was aided further by a 170bp margin improvement YoY , in line with guidance . Additional revenue from the O&M agreement with Gleneagles Hospital may have lifted margin .

Bed additions, Gleneagles deal add to growth but largely priced in: FORH plans to add ~900 beds to its operations in FY2 7, including some in flagship FMRI facility . Ramp -up of these beds add to growth visibility in FY27. FORH recently signed an O&M contract involving five hospitals from its sister concern – Gleneagles. Revenue f ees of 3% from these facilities would add to growth. Management expects room for further margin expansion in FY27, given the bed additions are mostly Brownfield in facilities that ar e doing well . However, we have already factored in most in to our estimates and discounted the stock price , accordingly .

Growth likely to pick up in the diagnostics segment: EBITDA margin of 23% in Q 3FY26 came in line with management’s full -year target. Revenue growth of 8.5% YoY in Q 3 still needs to pick up to meet guidance of double -digit growth in FY26. Rebranding exercise -related issues and associated marketing cost dragged growth and profitability in the diagnostics segment in FY25. However, t hose issues are behind us, and margin should improve hereafter. FORH has recently acquired the erstwhile SRL brand and management believes this will help further in customer acquisit ion and growth .

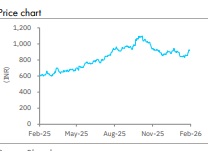

Downgrade to Reduce with an unchanged TP of INR 927: We keep our FY26 -28E EBITDA and core EPS estimates broadly unchanged. FORH trades at 53x FY2 7E core P/E and 30x FY2 7E EV/EBITDA (pre -IndAS). We keep our TP unchanged at INR 927 on 44.8 x FY 27E core P/E plus cash per share . We see limited upside after ~50% stock price performance in the past year. Hence, we downgrade our rating to Reduce from Accumulate . Value accretive deals with promoter companies or their associates are key risks to our call .

Please refer disclaimer at Report

SEBI Registration number is INH000000933

.jpg)

.jpg)