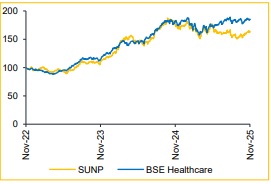

Add Sun Pharma Ltd For Target Rs. 1,825 By Choice Broking Ltd

Scaling Through Innovation

Launch Ramp-Up and GLP-1 Entry Strengthen Visibility

SUNP’s ongoing strategy to shift toward an innovative and specialty-led portfolio continues to deliver results, with a rising contribution from new launches such as Ilumya, Cequa, etc. We expect the company to maintain this momentum as these brands scale up. The company also remains on track to enter the GLP-1 market in India and Canada. With R&D spends normalizing after specialty expansion, we expect EBITDA margin to stay steady in FY26E, with potential for expansion in FY27E as high-value products gain operating leverage. Our FY27E estimates remain unchanged, and we continue to value the stock at 30x FY27–28E average EPS, leading to an unchanged TP of INR 1,825. We maintain our ADD rating supported by steady execution.

Steady Growth with Margin Expansion

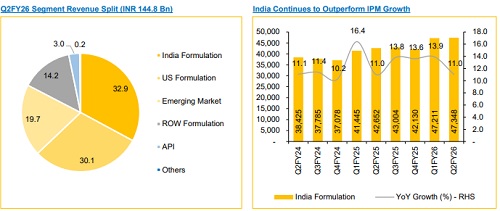

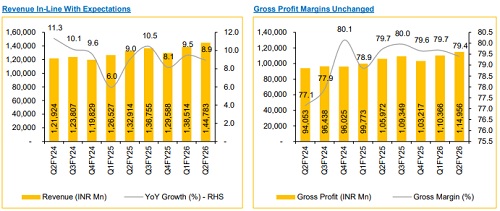

* Revenue grew 8.9% YoY / 4.5% QoQ to INR 144.8 Bn (vs. CIE estimate: INR 145.4 Bn).

* EBITDA grew 14.9% YoY / 5.2% QoQ to INR 45.3 Bn (vs. CIE estimate: INR 45.8 Bn); margin expanded 163 bps YoY / 21 bps QoQ to 31.3% (vs. CIE estimate: 31.5%).

* APAT increased 2.6% YoY / 8.6% QoQ to INR 31.2 Bn (vs. CIE estimate: INR 32.6 Bn).

India to Sustain IPM Outperformance Through Pipeline Strength

India grew 11% YoY, continuing to outpace IPM, driven primarily by new launches and volume growth, while IPM remained price-led. SUNP launched nine new products in Q2 across dermatology, cardiology, ophthalmology and gastro, sustaining leadership in these therapies. The company is on track to be part of the first wave of GLP-1 launches (injectable + oral). Driven by a robust launch pipeline and strong brand momentum, we believe SUNP remains wellpositioned to continue outperforming IPM growth.

Ilumya, Leqselvi Launch to Anchor Next Phase of US Expansion

While US revenue was flat YoY, the company witnessed a favourable product mix shift, with specialty/innovative products contributing more than generics. Key products—Ilumya, CEQUA, Leqselvi and Odomzo—continued to sustain growth momentum, while Unloxcyt is targeted for launch in H2. Management also indicated no tariff?related risk, given its US manufacturing footprint, and remains open to expanding capacity if required. Semaglutide (GLP-1) has been filed in Canada as well, though approval timelines remain uncertain. We expect high single-digit growth in the US business, led by a richer specialty mix and upcoming launches.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131