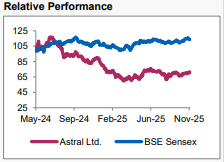

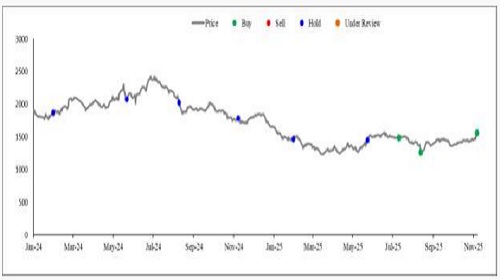

Buy Astral Ltd For the Target Rs. 1,750 by Axis Securities Ltd

Strategic Capacity Set Stage for Margin Expansion; Maintain BUY

Est. Vs. Actual for Q2FY26: Revenue – BEAT; EBITDA (Adj.) – BEAT; PAT – BEAT

Changes in Estimates Post Q2FY26 Result

FY26E/FY27E: Revenue: 0%/0%; EBITDA (Adj.): 0%/0%; PAT : -2.2%/-1.9%

Recommendation Rationale

* Maturing Capex Cycle and Operational Leverage: Astral is entering a high-growth phase as its multi-year Capex plan begins to mature. The company invested Rs 1,400 Cr over the last four years, leading to the commissioning of new facilities in Hyderabad and Kanpur. These new units are currently operating at low utilisation (15-20%) and are temporarily dragging margins. However, as utilisation scales up to the 40-50% level in the coming quarters, this new capacity will yield significant operational leverage. Additionally, localised production will reduce logistics costs, which the company will use to strategically drive further market share gains, cementing its competitive advantage for years to come.

* Operational Performance: Overall, the demand scenario in the industry was weak and saw an average price drop of 10.6% YoY. Despite this, the company managed to achieve volume growth of 20.6% and value growth of 15.7% for its plumbing business. This showcases Astral’s focus on growing its value-added products. This translated to a higher EBITDA of 20% for the plumbing business. Its adhesive revenue grew by 13.6% delivering EBITDAM of 12.1%. During the quarter, the bathware business achieved sales of Rs 33 Cr vs 29 Cr last year, showing 13.8%growth. The paint business recorded a 17.1% YoY increase in sales for Q2FY26.

* Margin Improvement and Backward Integration: Astral is focused on maintaining healthy margins despite volatile polymer prices. The company has guided for its core Adhesives segment to maintain stable margins in the 15% to 16% range. The management expects a big margin improvement in the coming years due to a key strategic backward integration move. By building its own CPVC resin plant, Astral will no longer have to import raw materials, which will lower its costs and reduce the amount of cash tied up in imported inventory. This move, which requires no new cash investment and is expected to be commissioned by Sep’26, will save money and give the company full control over the quality of its product, acting as a significant game-changer for long-term profitability.

Sector Outlook: Positive

Company Outlook & Guidance: Astral's outlook is robust, with the company being confident in achieving its existing guidance of a double-digit volume growth for its Plumbing business. Margins across the consolidated entity are projected to remain in the healthy 15% to 16% EBITDA range. The Paint division is expected to grow by 20% for the full year, with substantial margin recovery anticipated by the end of the next fiscal year. Astral is strategically positioned to leverage its capacity and backward integration. It focuses on growth across all verticals and a commitment to deliver consistent performance.

Current Valuation: 51x FY27E EPS (Earlier 55x FY27E EPS)

Current TP: Rs 1,750/share (Earlier TP: Rs 1,680/share)

Recommendation: We maintain our BUY recommendation on the stock.

Financial Performance

Astral’s performance for the quarter was a beat on all fronts, driven by strong volume growth. It reported revenue of Rs 1,577 Cr, up 15% YoY, beating our estimates. Gross margins went up by 72 bps YoY at 39.6%. Reported EBITDA stood at Rs 257 Cr, reflecting a 22% YoY growth, with EBITDA margins at 16.3%, up 95 bps YoY. PAT came in at Rs 135 Cr, up 24% YoY. Plumbing revenues grew 16%, with volume growth of 21% YoY, a 4% drop in realisations, and EBITDA margins at 19% versus 18.4% YoY. The Paints and Adhesives business posted a 14% YoY revenue increase, with EBITDA margins at 12% compared to 10.3% in the previous year

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633