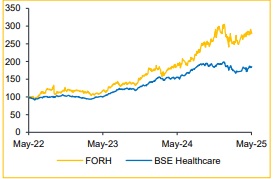

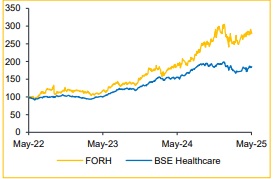

Buy Fortis Healthcare Ltd For Target Rs. 780 - Choice Broking Ltd

Strong Core + Diagnostic Tailwinds = Compelling Growth Story:

FORH is well-positioned for strong growth, with hospital EBITDA margins rising to 20.5% and ~1,000 new beds to be added via brownfield expansion. Change in specialty mix towards the high-margin therapies are driving margin gains. Agilus Diagnostics, now with 4,171 touchpoints, saw EBITDA margins (ex-one-offs) improve to 23.4%, targeting 25% ahead.

View and Valuation:

With dual levers of hospital margin expansion and diagnostics scale-up, Fortis is executing well on its cluster strategy (refer exhibit 1). We have maintained our multiple and rating to ‘BUY’ with a target price of INR 780, valuing the company on an SOTP basis (refer exhibit 2). The hospital business is valued at 23x EV/EBITDA, reflecting continued ARPOB growth and capacity expansion, while the diagnostic business is valued at 16x EV/EBITDA, factoring the margin improvement. We expect the company’s case mix to improve further, supporting overall margin expansion.

Revenue In-Line; EBITDA Margin and PAT Beat Expectations

* Revenue grew 12.4% YoY / 4.1% QoQ to INR 21.1 Bn (in-line with consensus estimate: INR 20.2 Bn)

* Hospital revenue grew by 14.2% YoY to INR 17.1 Bn; Diagnostic revenue increased by 3% YoY to INR 3.5 Bn.

* ARPOB grew by 8.2% YoY and 2.4% QoQ to INR 68,767, with occupancy at 69%.

* EBITDA rose 14.3% YoY and 16.1% QoQ to INR 4.4 Bn; margins improved by 36 bps YoY and 224 bps QoQ to 21.7% (vs. consensus: 21.0%).

* PAT grew by 28.4% YoY / (5.3)% QoQ to INR 2.3 Bn (vs. consensus estimate: INR 2.2 Bn).

Core Hospital Business on a Margin Expansion Trajectory

FORH delivered strong business with hospital EBITDA margins improving to 20.5% (from 18.6% YoY) and overall EBITDA rising 20.4% YoY. Growth was based across specialties, notably oncology (+25%) and neurosciences (+19%). Occupancy improved to 69%, supported by increased ARPOB (+9%) and robotic surgery volumes (+72%). We expect margin to grow by another 200bps in FY26 on the back of brownfield ramp-ups and strong operating leverage. ~1,000 new beds being added in FY26 (through brownfield expansion in Noida, Faridabad, FMRI, BG Road, and Jalandhar), we expect it to capitalize on operating leverage, especially as these facilities are coming up in clusters with existing high occupancy (>75%).

Agilus Diagnostics: Margin Rebound with Double-Digit Growth Visibility

Agilus (formerly SRL) has emerged as a focused, profitable diagnostic brand with Q4FY25 EBITDA margins at 23.4% (ex-one-offs) and plans to reach 25% in the near term. Revenue from preventive testing grew 13%, and network expansion to 4,171 touchpoints gives it scale. The rebranding is complete, one-offs are behind, and Fortis now owns 89.2% of Agilus—signaling confidence in its long-term earnings potential. Management guides for double-digit revenue growth in FY26.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

.jpg)