Buy Hyundai Motor India Ltd For Target Rs. 2,086 By Yes Securities Ltd

Weak gross margins; one-offs dent profitability

View – Well positioned to ride premiumization trend in India

Hyundai Motor India (HMI) 3QFY25 performance was impacted by ~2.3% YoY lower exports, weak gross margins and one-off in staff cost (~60bp), leading to a 160bp YoY/150bp QoQ EBITDA margin contraction to 11.3%. While the PV industry’s demand remains moderate, we expect HMI to post steady growth given its favorable SUV mix and strong export opportunities going forward. Although HMIL is aligned well with PV segment trends, its growth has been capacity-constrained as reflected in lower domestic volume CAGR of ~9% (vs ~16% for industry) over FY21-24. The GM plant acquisition will surely boost growth through vital capacity addition in phases. Besides leveraging the strong parentage of Hyundai Motor Corp (HMC), HMI is fast evolving in line with a dynamically changing tech landscape, which will slash lead times for new product development, make India franchise definitively robust, and help strengthen exports (~21% volume share in FY24).

HMIL is likely to become a thriving export hub for HMC. Further, it has consistently launched/revamped models with recently launched Creta EV at aggressive price points. We see the MPV segment as a portfolio gap, which means HMI can gainfully challenge the duopoly of MSIL and Kia. Its impressive earnings should continue unabated; we estimate Volumes/Revenue/EBITDA/Adj.PAT CAGR of 8.2%/11.5%/17.6%/14.3% over FY25-27E. We broadly retain our FY26E/27E EPS. We value HMI at 23x Mar’27 EPS to arrive at TP of Rs2,086, given its strong parent support for new technology, superior financial metrics, a relatively premium brand perception, and better alignment with industry trends. We prefer M&M, TVSL followed by HMIL among OEMs from our coverage universe.

Result Highlights – Operational miss led by weak gross margins

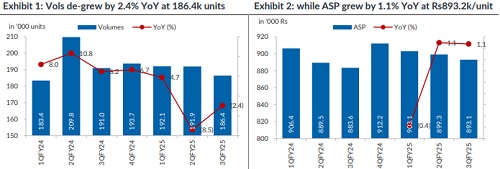

* Revenues degrew ~1.3% YoY/-3.5% QoQ at ~Rs166.5b (est ~Rs168.6b) led by - 2.4% YoY (-2.9% QoQ) decline in volumes at 186.4k while ASP grew 2.4% YoY/ +0.6% QoQ at ~Rs893.1k/unit (est ~Rs904.8k/unit).

* Gross margins expanded ~20bp YoY (-60bp QoQ) at 26.9% (est 27.8%). Staff cost too came in higher at ~Rs6.07b (+20% YoY/ +10.5% QoQ), led to EBITDA degrowth of ~13.7% YoY/-15% QoQ at ~Rs18.75b (est Rs21.9b). Co indicated one time impact of ~60bp of sales incentives for employees in 3QFY25. Consequently, margins contracted 160bp YoY/ -150bp QoQ at 11.3% (est 13%, cons 12.4%).

* Weak op. performance partially offset by higher other income at Rs2.4b (est Rs2b, +27% QoQ) led to Adj. PAT came in lower at ~Rs11.6b (-18.6% YoY est ~Rs13.7b).

* 9MFY25 revenue/EBITDA/Adj.PAT grew -1.7%/-2.9%/-8.1%.

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632