Add Astra Microwave Ltd for the Target Rs.1,175 by Choice Broking Ltd

All-round beat in Q1, yet management cautious:

We believe ASTM’s FY26 guidance of 18–20% revenue growth and INR 1,300–1,400 Cr order inflows seem to be modest as compared to the scale of opportunities emerging in India’s defence and space ecosystem. In our view, ASTM’s presence across radar, anti-drone systems and space programs positions it to outperform although management commentary reflects caution.

We expect margin to remain resilient and may even expand, supported by higher domestic business and reduced Build-to-Print exposure. Q1FY26 margin already reflects this trend.

In our view, ASTM is structurally well-placed to capitalise on the strong tailwind. We have introduced FY28E numbers and valued the stock at 40x of the average of FY27/28E EPS. Based on this, we arrived at a TP of INR 1,175, upgrading our rating to ‘ADD’ (from ‘REDUCE’). We expect Revenue/EBITDA/PAT to expand 21.8%/22.3%/26.2% CAGR over FY25–28E.

We foresee optionality emerging from three areas: (1) Accelerated radar modernisation under DRDO, (2) Strong traction in the space vertical and (3) Adoption of anti-drone systems having advanced jamming features. Any meaningful upside to these programs could prompt us to revisit our stance with a more constructive assessment.

Outperforms on All Key Metrics;

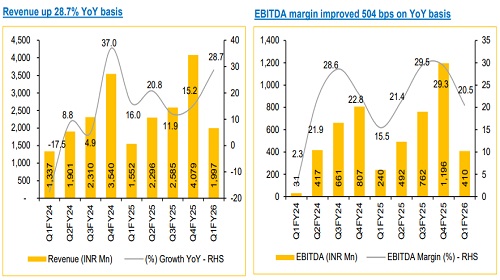

* Revenue for Q1FY26 up 28.7% YoY and down 51.0% QoQ at INR 1,997 Mn (vs CIE Est. INR 1,781 Mn)

* EBIDTA for Q1FY26 up 70.6% YoY and down 65.7% QoQ at INR 410 Mn (vs CIE Est. INR 321 Mn). The EBITDA margin stood at 20.5%, improved 504 bps YoY (vs CIE Est. of 18.0%)

* PAT for Q1FY26 up 125.9% YoY and down 77.8% QoQ at INR 163 Mn (vs CIE Est. INR 127 Mn). PAT margin improved 351 bps YoY, reaching 8.1% (vs CIE Est. 7.2%).

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131