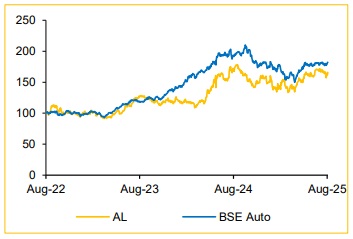

Buy Ashok Leyland Ltd for the Target Rs.150 by Choice Broking Ltd

Expanding Market Share and Product Portfolio

AL has steadily gained retail market share across both MHCV and LCV categories in Q1FY26, with MHCV share rising to 31.1% from 29.8% YoY, and LCV share improving to 12.9%, despite a 2% industry decline.

Product launches in higher horsepower MHCVs (280–360 HP tippers, tractor trailers, and multi-axle vehicles) position the company to tap demand in mining, construction, and logistics. AL also plans a bi-fuel LCV product for launch to meet demand in large metros, along with many upgraded products for international markets. The upcoming LNG truck launch also opens a new segment in alternative fuels. Additionally, AL is upgrading buses (13.5m and 15m), catering to both domestic and export markets.

We believe, these differentiated offerings will help AL strengthen pricing power, customer stickiness, and competitive positioning. With demand revival expected post-monsoon and government infrastructure push AL’s expanded product pipeline positions it for sustainable future growth.

View and Valuation: We revise our FY26/27 EPS estimates down by 2.0%/5.5%. We value the core business at 20x (unchanged) on the average FY27/28E EPS, while we introduce FY28 estimates and arrive at a value of INR 131. We assign a value of INR 15 to HLFL and INR 4 to Switch Mobility (as detailed in Exhibit 1), leading to a revised target price of INR 150. We maintain our BUY rating on the stock.

Q1FY26 results are in line with the estimates

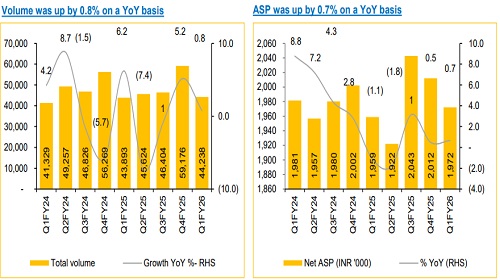

* Revenue was up 1.5% YoY and down 26.7% QoQ to INR 87,245Mn (vs consensus est. at INR 87,921Mn) led by 0.8% YoY growth in volume and 0.7% YoY growth in ASP.

* EBITDA was up 6.4% YoY and down 45.9% QoQ to INR 9,696Mn (vs consensus est. at INR 9,745Mn). EBITDA margin was up 52bps YoY and down 393bps QoQ to 11.1% (vs consensus est. at 11.1%).

* APAT was up 13.0% YoY and down 52.7% QoQ to INR 5,937Mn (vs consensus est. at INR 5,980Mn).

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131